The British pound is often closely linked to risk demand in global markets due to London’s position as a significant financial hub. However, the UK and European stocks have performed well since last Wednesday, while the pound and the euro have been methodically losing ground.

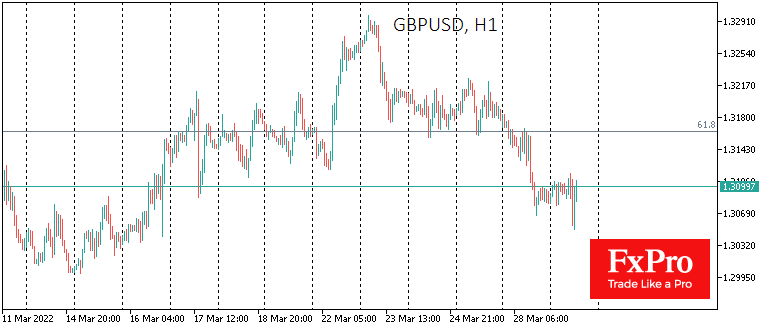

GBPUSD fell earlier on Tuesday to a 3-week low, briefly hovering under 1.3050, but soon returned to 1.3100 on data indicating increasing lending in February.

Although the tightening of monetary policy is designed to cool the credit market, at the start of this process and against a background of accelerating inflation, it makes sense for households to spend to buy durable goods and borrow while rates remain low.

Buoyant stock market performance and a robust macroeconomic backdrop make for an optimistic outlook for GBPUSD, making the pair an attractive buy on a downturn.

The FxPro Analyst Team