The Dollar Index is retreating from Thursday’s highs, moving against the logic of fundamental forces. This behaviour begs the question: either the Dollar Index has reached the limits of its range, or this is an extended shake-out of positions after a prolonged rally.

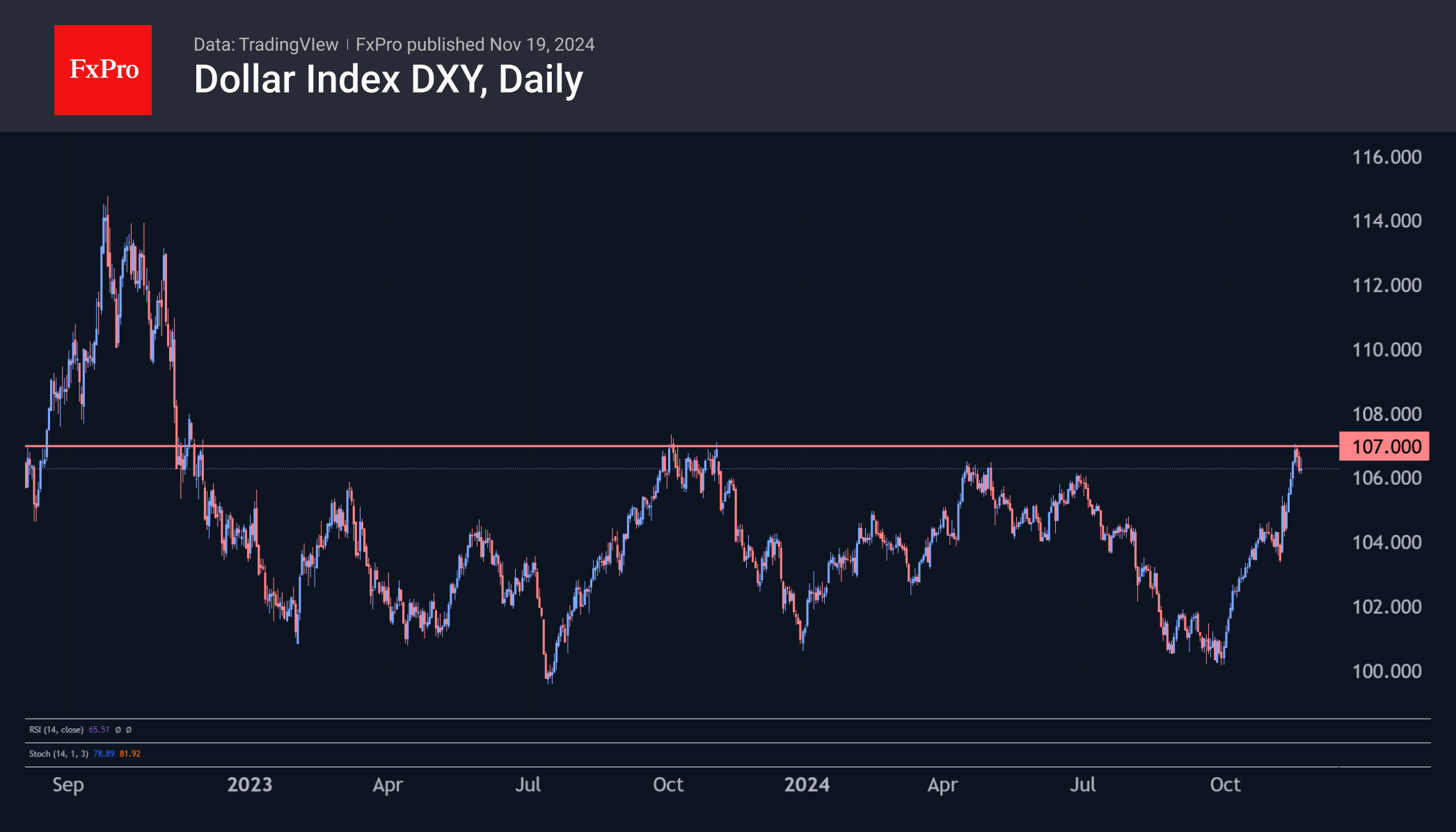

The DXY rallied to 106.99 last Thursday, almost repeating the October 2023 highs of 107.04. The recent highs were slightly above the April peak this year, making 107 a serious resistance area. There is a significant battle going on here in the dollar between the bulls and bears, the outcome of which could determine the trend for weeks or months to come.

The resistance is so significant that it goes against the major trends of recent days. At the end of last week, Fed Chairman Powell said that the central bank was in no hurry to cut interest rates. As a result, interest rate futures are already pricing in more than a 40% chance of no change, whereas there was no doubt at the beginning of October. The pullback in equity indices also clearly showed how much the markets took the central bank chief’s words to heart.

The authorisation of US missile strikes deep into Russia, and the retaliatory escalation of rhetoric also led to a pullback in defensive assets, helping gold and the yen, but not the dollar, which has not fallen below 1.05 in EURUSD terms. However, in the current geopolitical environment and amid expectations of tariff wars with the US, it isn’t easy to see the euro as a safe-haven.

In our view, EURUSD holding above 1.05 looks like a technical correction and a liquidity pick-up after a 6% fall since early October. As the odds of no change in US interest rates continue to rise, the dollar can build up potential that is still constrained by the local overbought condition of the US currency.

However, the ball is now in Europe’s court. On Wednesday, it is worth listening to Lagarde and the ECB’s biannual assessment of financial stability. On Friday, it is also worth paying attention to another speech by Lagarde entitled ‘Out of the Comfort Zone…’ and the preliminary PMI estimates for November, which have often been the driving force behind the euro’s movement and could now indicate either a light at the end of the tunnel or a further plunge.

The FxPro Analyst Team