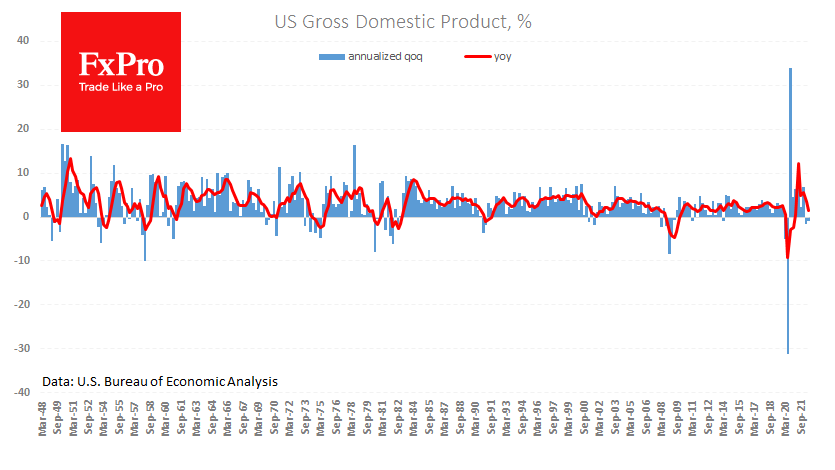

The US economy slipped into a technical recession. Preliminary estimates for the second quarter recorded a fall of 0.9% after a decline of 1.6% (seasonally adjusted data annulled). Despite the frightening figures in the headline, the US economy has lost 0.6% in the last two quarters, if we count as Europe does – a fall, but not a big one.

Nevertheless, we should remember that this dip results from a decrease in budget spending following the end of covid-related programs and real estate investment but is not a result of a rate hike. Monetary policy acts on the economy with a lag of approximately six months. Therefore, only the results of current decisions will be available at the end of the fourth quarter.

The current economic data indicates that the state’s tightening of monetary policy has already moved into a cooling-off phase and has returned to its long-term GDP growth trend.

With such input data, the chances increase that the Fed will soon slow down sharply the pace of rate hikes and could move to policy easing rather quickly. It is worth remembering that in 2018 the Fed raised its rate to 2.5%, which caused markets to collapse and forced the regulator to move to policy easing soon afterwards.

The FxPro Analyst Team