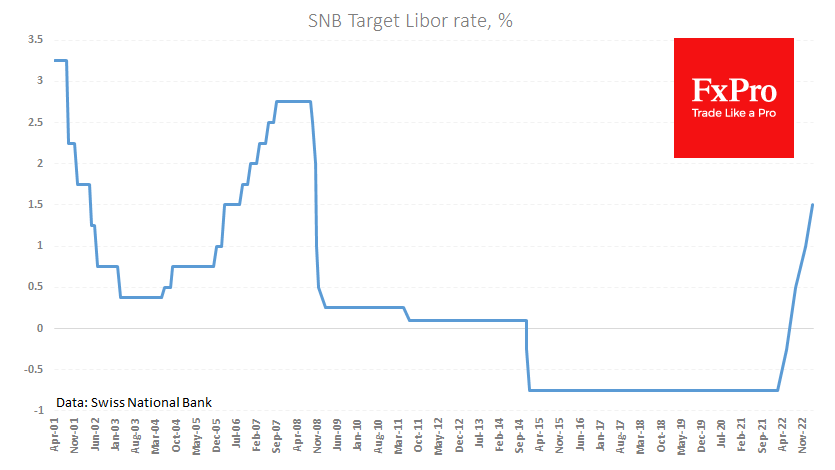

The Swiss National Bank continued to tighten its monetary policy by raising its key interest rate by 50 points to 1.5% today. This decision is broadly in line with the market expectations of economists prior to the Credit Suisse story. The decision mainly shares the same logic with that of the Fed and the ECB: It is important to move within market expectations to avoid market chaos.

The SNB has raised rates by 225 bp over the recent tightening cycle, less than the Fed (475 bp) and the ECB (350 bp) did. However, this has not been a problem for the CHF, which is roughly at the same level as a year ago against the dollar and has strengthened against the euro for several reasons.

The Swiss central bank had more room to manoeuvre thanks to lower inflation. At 3.4%, it is still a concern but not as much of a problem as in the US (6%) or the eurozone (8.5%). Adjusted for inflation, real interest rates in Switzerland are not as deeply negative as in most other developed countries.

In addition, the SNB continues to signal its willingness to act in the foreign exchange market by selling some of its huge reserves. Such moves quickly strengthen the franc, contributing to pressure on import prices, but indirectly affecting general financial conditions.

At the same time, in its comments on the interest rate decision, the SNB indicated its willingness to raise rates further, citing strong second round effects and high inflationary pressures abroad.

In our view, the Credit Suisse case has increased the need for a rate hike to make Swiss franc deposits more attractive for foreigners. This is a U-turn of the policy of the past decade of capital inflows amid “global zero interest rates”. Now that interest rates are significantly higher in the US and Europe, and with UBS and the risk of “contagion” from Credit Suisse constantly in the news, Switzerland will have to actively compete for global deposits in order not to provoke unnecessary pressure on the franc.

The FxPro Analyst Team