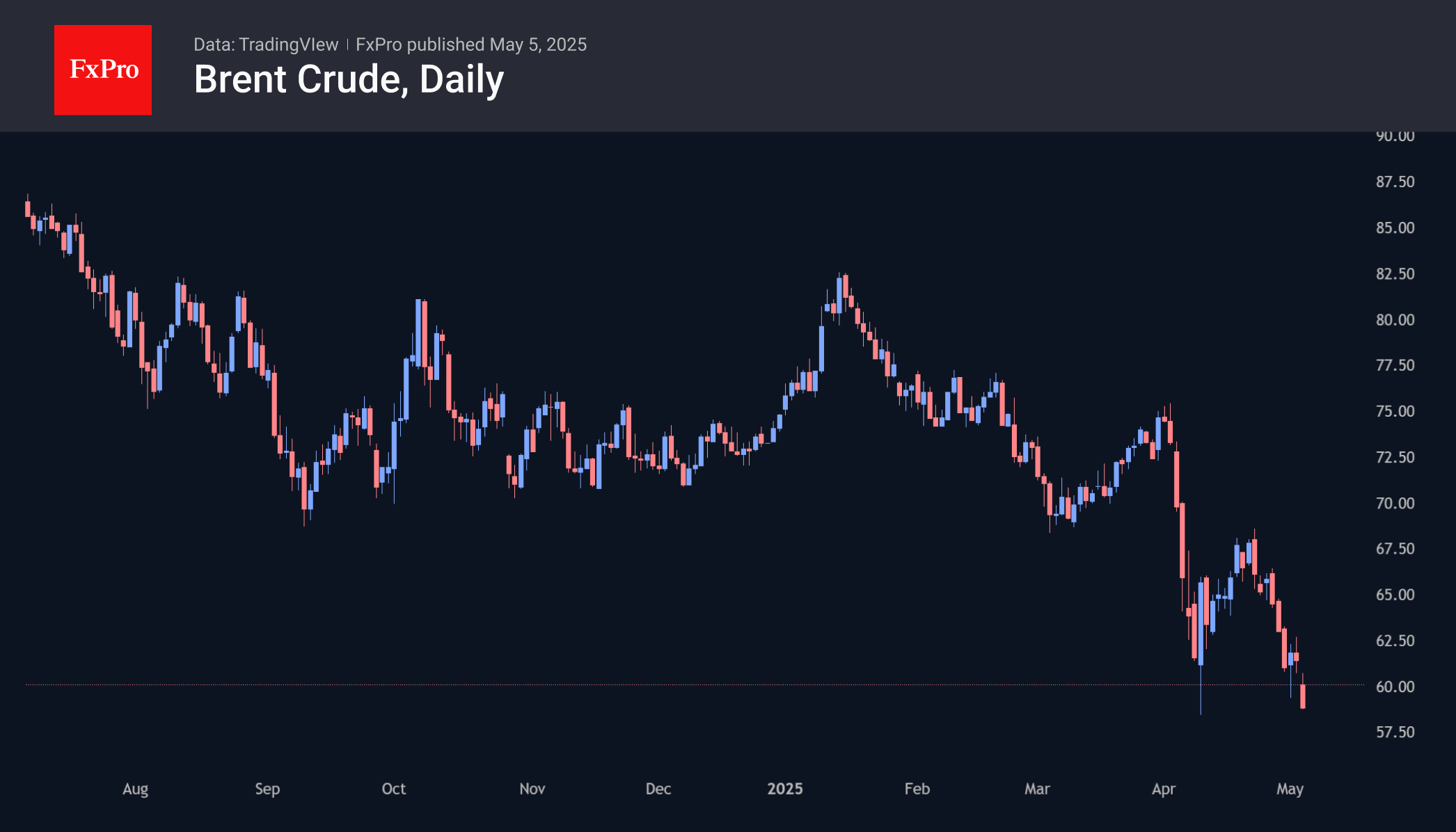

Oil opened this week down 4% after OPEC+ announced its intention to increase production by 411K bpd from June. The change represents the phasing out of voluntary restrictions by major producers, including Saudi Arabia and Russia, which previously totalled 2.2m bpd.

The decision surprised the market, which had expected an increase of about 244K barrels. Last month, an increase of 135 thousand barrels per day was forecast. These measures can be seen as Saudi Arabia’s response to the loss of market share caused by the active increase in production by competitors outside the cartel and the exceeding of quotas by several OPEC colleagues.

Saudi Arabia’s strategy assumes lower oil prices in the coming months, which will benefit only the most sustainable projects. Low production costs allow the Kingdom to realise this strategy. In addition, low hydrocarbon prices may affect the development of the renewable energy industry.

Saudi Arabia already used a similar tactic in 2014. Then, as is the case now, the price of oil was falling due to a slowdown in final demand and the desire to increase production, as well as high drilling activity in the US due to the shale revolution. From a peak in July 2014, the price fell by three-quarters, hitting a low a year and a half later.

Oil faced another perfect storm in 2020 when record US production coincided with a supply conflict between Russia and Saudi Arabia. The COVID-19 pandemic exacerbated the sell-off. As a result, Brent has lost around 72 per cent of its January 2020 peak, and nearby WTI futures have gone into negative territory.

In the current environment, a 70-75% decline in oil prices suggests a downturn to $20-25 per barrel of Brent. However, this scenario is for a possible market crash like March-April 2020. The price has not fallen below $35 per barrel Brent in the last 20 years, and the $40 area is soft support. When approaching these levels, major producing countries have shown a willingness to negotiate and coordinate.

Despite possible changes in this context, downside targets to the $40 area still look ambitious. Lower levels represent a disproportionate risk-return ratio. At prices below $50, many projects lose profitability, while their number increases significantly as we approach $40.

The FxPro Analyst Team