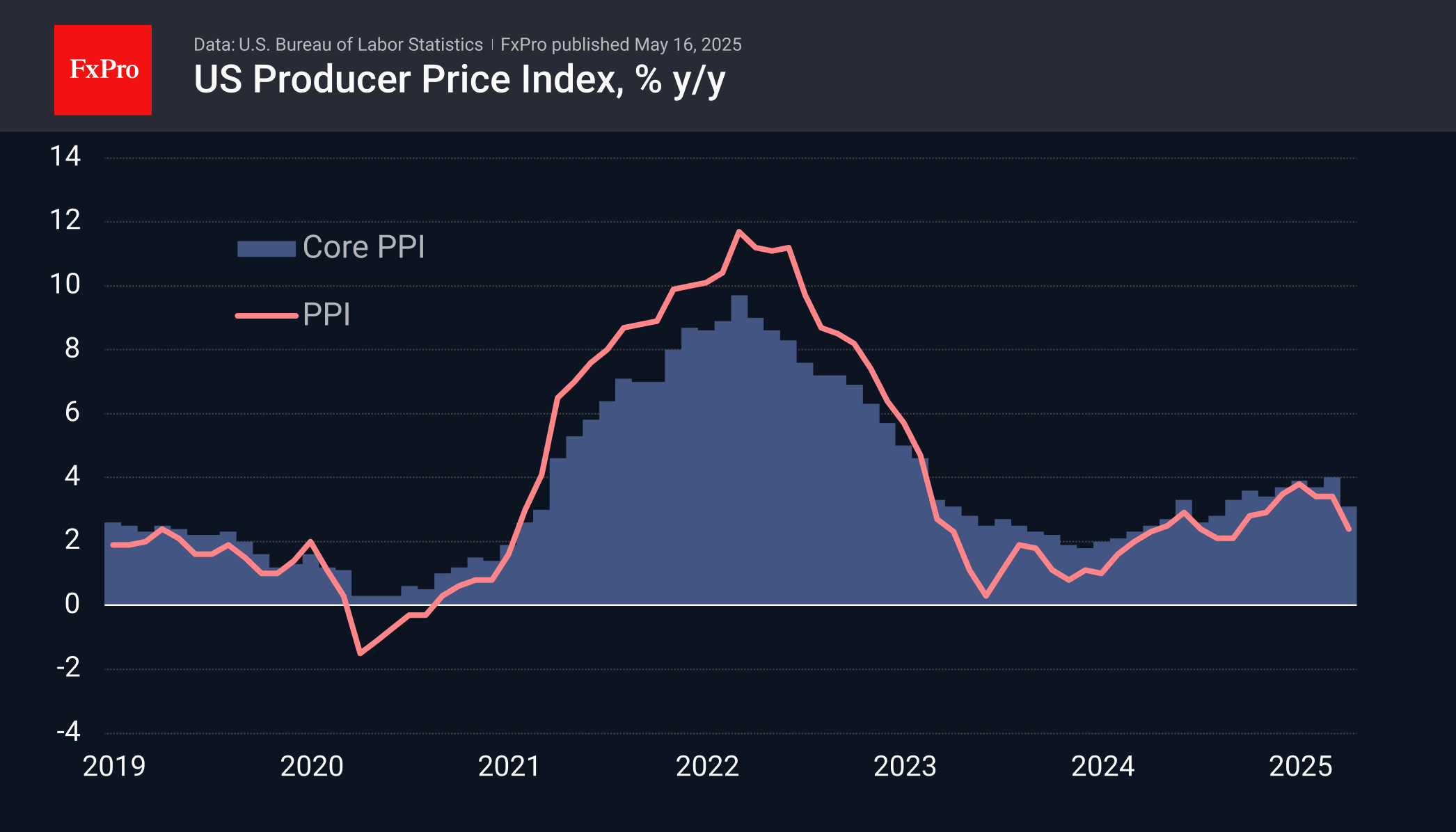

US statistics produced a shocking dive in producer prices, with everyone guessing how strong the upward spurt might be. Producer prices for April fell 0.5% after 0.0% a month earlier. March’s value was heavily revised upward from -0.4%.

The shift in price declines has tinted the April data, and there is now little sign of a shock increase in response to tariffs. Of course, goods under the new tariffs won’t arrive en masse in the States until the second half of May, but America didn’t experience massive price increases in advance, which is relatively good news.

The markets virtually ignored this very bearish news: the chance of the rate remaining at the current level after the next two meetings fell from 65% to 61%. By comparison, it was less than 6% a month earlier, and markets were pricing in 2-3 rate cuts by 30 July. This shift in expectations is certainly behind the reversal of the dollar’s trend from declining to rising 2.5% over the past month. However, that only recovered a quarter of the dollar’s decline over the previous four months of sell-offs.

The dollar’s upward movement is more appropriately called a rebound for now, the strength of which is receding. Technically, the DXY’s rise was interrupted at the touch of the 50-day moving average on Monday, failing its first test of trend strength, and has been drifting downward ever since. The latest dynamic also emphasises the importance of DXY’s multi-year support near 100, which has now become resistance.

The FxPro Analyst Team