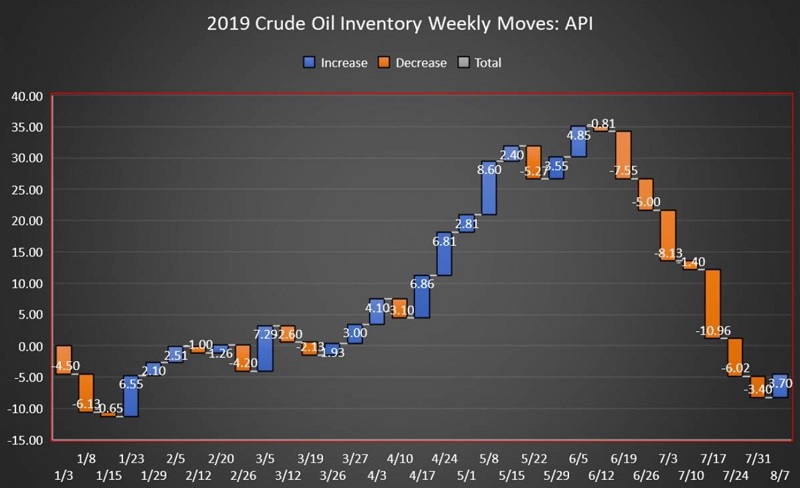

The American Petroleum Institute (API) has reported a crude oil inventory draw of 3.45 million barrels for the week ending Aug 15, compared to analyst expectations of a 1.889-million barrel draw. The inventory build this week compares to last week’s surprise build of 3.7 million barrels, according to API data. A day later, the EIA estimated that there was an inventory build of 1.6 million barrels.

After today’s inventory move, the net draw for the year is 7.98 million barrels for the 34-week reporting period so far, using API data. Oil prices were trading up on Tuesday prior to the data release as the market clawed its way back up after reaching 2019 lows last week as prospects for demand growth dimmed in the wake of the ongoing trade dispute between China and the United States. At 10:54am EST, WTI was trading up $0.11 (+0.20%) at $56.25—roughly $0.50 down from last week’s price. Brent was trading up $0.43 (+0.72%) at $60.17, also roughly $0.50 down from last week.

The API this week reported a 403,000-barrel draw in gasoline inventories for week ending Aug 15. Analysts predicted a build in gasoline inventories of 169,000 barrels for the week. Distillate inventories rose by 1.806 million barrels for the week, while inventories at Cushing fell by 2.803 million barrels. US crude oil production as estimated by the Energy Information Administration showed that production for the week ending August 8 stayed the same at 12.3 million bpd, just 100,000 bpd off the all-time high of 12.4 million bpd.