The latest US report was a reminder that the fight against inflation will not be easy. We would guess that the most challenging period for the authorities has just begun.

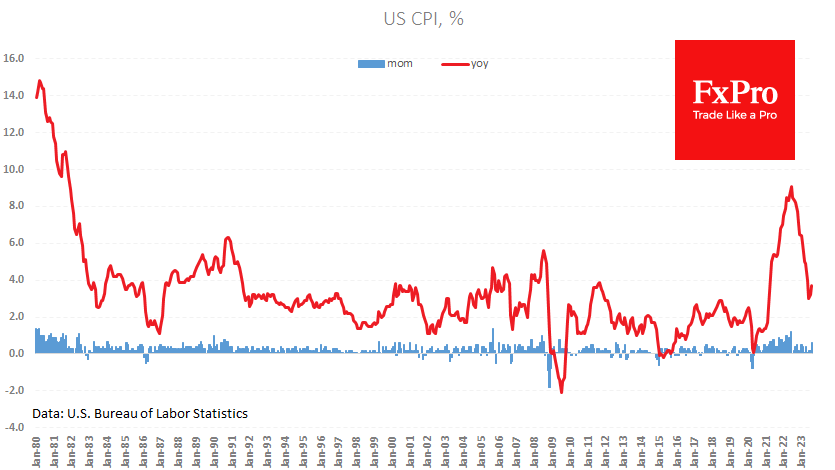

In August, the US CPI rose by 0.6% m/m, taking the annual rate to 3.7%. The latest reading was above the average forecast (3.6%) and accelerated from 3.0% in June and 3.2% in July. Roughly half of the price rise can be explained by the increase in fuel prices. Since the end of August, exchange-traded oil prices have regained their upward momentum, which could pose a problem for the monetary authorities in the coming months.

The core price index – excluding energy and food – rose by 0.3% m/m after two months of 0.2% growth. The annual rate of increase slowed from 4.7% to 4.3%. Although the annual rate continues to fall, it remains elevated. Core inflation rose by 1.8% over six months. That’s double the average annual rate ten years before the pandemic.

Interestingly, the new release seems to have only reinforced the markets’ view that the Fed is done raising rates. The odds of keeping rates on hold in November rose to 57% from 53% a week earlier, hardly in keeping with the picture painted by the more robust recent inflation data.

The FxPro Analyst Team