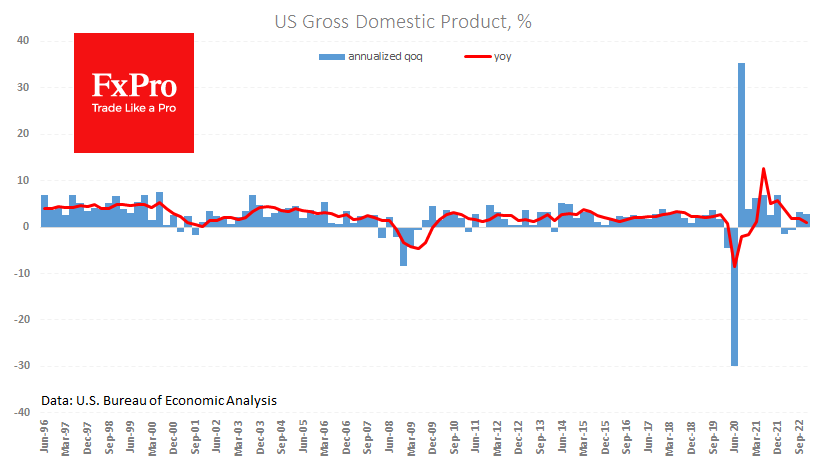

The preliminary estimate for the fourth quarter showed annualised growth of 2.9% (quarter-on-quarter growth multiplied by 4). This is a slowdown from the previous period (3.2%) but better than expected (2.6%).

Compared to the same quarter a year ago, the economy grew by only 1.0%, after 1.9% in the previous quarter. This growth is well below the trend rate (around 2% on average since 2000), reflecting the difficulties of growth in an environment of sharply rising interest rates.

Stronger-than-expected GDP growth could be seen as good news for the stock market. Investors can bet that the economy is adjusting relatively well to monetary tightening. But this is a very fragile hypothesis, as strong growth in the current monetary cycle will allow the Fed to raise rates faster or further than previously expected. Much of the rise in the Nasdaq100 since the start of the year has been driven by expectations that rates will be cut before the end of the year, despite assurances of the contrary from Fed officials.

In addition, the dollar index is hitting multi-month lows in the currency market, confirming that expectations of Fed dovishness are the main driver. The norm, in this case, would be for the dollar to strengthen in response to better-than-expected GDP growth data.

The combination of data and market reaction makes it necessary to pay close attention to what signals the Fed will send out after next Wednesday’s meeting.

The FxPro Analyst Team