Global markets have retreated from the highs reached yesterday, which can largely be attributed to the desire of some players to lock in some gains after the big moves earlier this week. The main culprit for the market movements was the weakening of the US currency, which caused a rush in demand for several assets.

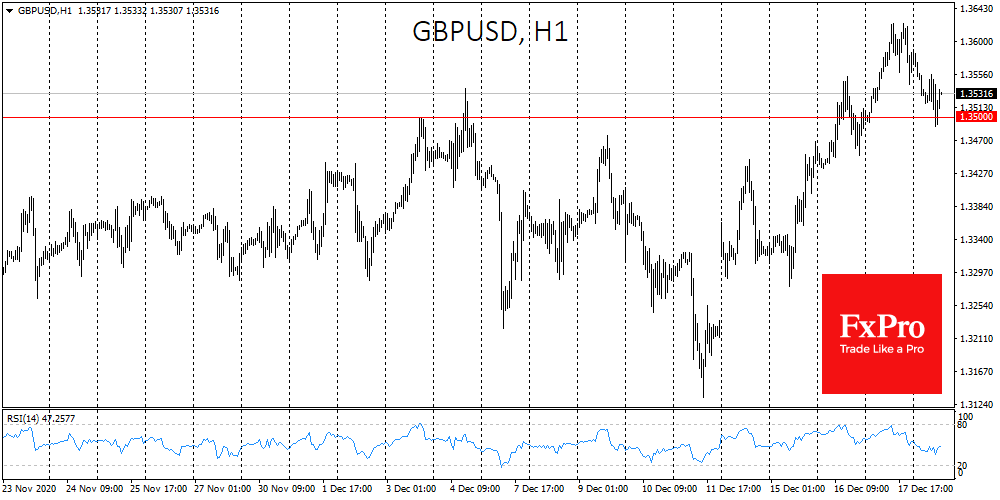

Quickly brushing off the problems surrounding Brexit, GBPUSD jumped 2.5% in less than three days up to Thursday. With a sharp outbreak, the pair overcame resistance in the 1.3500 area, at one point rising above 1.3620. On Friday, the former resistance is now being tested as support. Keeping the pair above 1.3500 by the end of the week will increase the bulls’ confidence for the remaining days of the year.

An even better technical picture works in favour of the euro. Right now, the EURUSD is trading at 1.2260, quickly shaking off the sentiment of a correction earlier in the day. Despite the rise in the pound, the euro managed to stay above the 50- and 200-day averages, reflecting the prevailing bullish sentiment. EURJPY rose above 127, finding itself in the area of the highs of the last two years.

The gains of EUR against USD and JPY could be an important signal that the markets remain optimistic and that the current drawdown on several markets and instruments may be just a short-term shake-up of portfolios, but with a bullish view still in sight.

However, traders should also consider another option. Macroeconomic reports of the last few days have shown time and again that Europe is doing relatively well despite the second wave of the pandemic. The German Ifo released just a few minutes ago beat expectations by showing an increase of the Business Climate Index in December to 92.1, contrary to an expected drop from 90.9 to 90.2.

Rising producer prices beyond expectations and a higher current account surplus are further signs of a eurozone that may today boost interest in the single currency as well as underlining a robust demand for the region’s goods abroad.

The FxPro Analyst Team