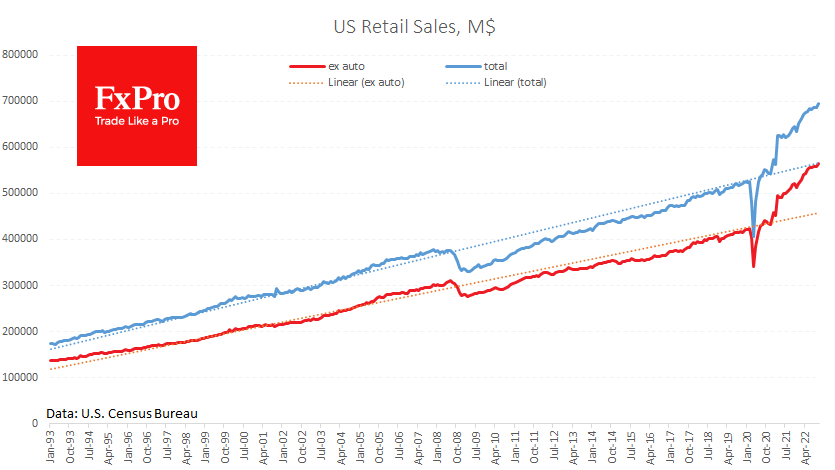

According to the latest U.S. Census Bureau estimate, US retail sales rose 1.3% in October. Americans’ purchases rose by 8.4% y/y, although an inflation adjustment (7.7% y/y last month) spoils the impression of a sales boom.

On the other hand, the Fed is making the most significant effort in the last 40 years to cool consumer demand, so the current result is hardly satisfactory.

Strong retail sales (or above expectations) boost the dollar and often spur demand in the stock market. This time we can only see the first part of this rule working, as solid retail activity feeds an inflationary spiral.

In response to a strong labour market and retail activity, the Fed may return to a tighter monetary policy line, returning market participants’ focus to a higher final rate – closer to 5.5% versus 5%.

The FxPro Analyst Team