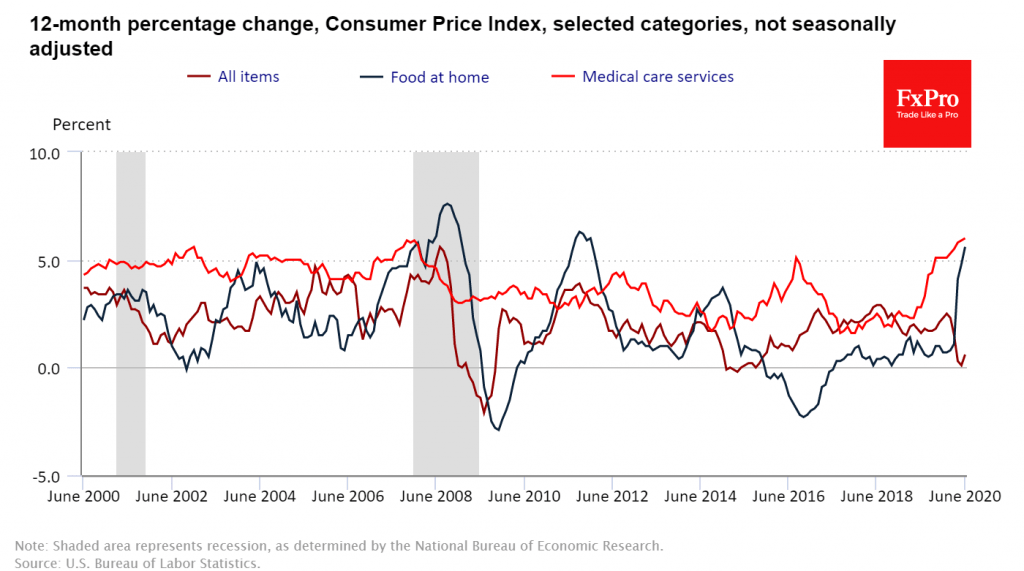

US consumer prices in June rose more than expected, to 0.6% y / y in June, adding the same per month. The main driver was fuel prices (+ 12.3% m / m), which is not surprising in light of the jump in oil exchange prices. Medical expenses are growing at a record pace, adding 6% y / y, which is easily explained by the continuing difficult situation with coronavirus in the USA.

Apart from this, for the third month in a row, we have noted inflation in food at home prices. An increase of 0.7% in June followed a jump of 2.6% and 1.0% in the previous two months. Over the last 12 months, this index increased by 5.6%. The weight of this category is just about 8%, but since buyers often shop for products, rising prices may push inflation expectations. In turn, getting out of control of inflationary expectations may keep the Fed from further easing monetary policy, which could seriously worsen the mood in the financial markets.

The FxPro Analyst Team