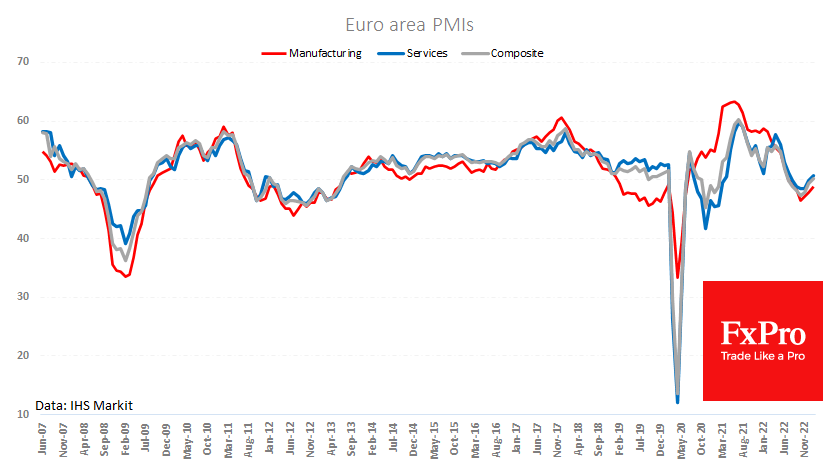

According to Markit’s preliminary estimates of business activity, the Eurozone economy has moved out of contraction and is trying to claw its way into growth. The eurozone composite PMI rose from 49.3 to 50.2, better than the expected 49.8. The rebound was driven by growth in the region’s services sector, which responded positively to lower inflation and falling gas prices.

However, these better-than-expected data were insufficient to support further gains for the Euro. On the contrary, the release of stronger German data put pressure on the single currency, which subsequently increased with the release of aggregate data.

We are witnessing a classic sell-off reaction as traders took profits after yesterday’s touch above 1.09. It should also be noted that the European equity market is directly linked to the EUR’s momentum, as it affects the attractiveness of local assets. The strong data now sets the mood for a more aggressive tightening by the ECB soon, which will weigh more heavily on the region’s economy.

Nor can we write off the accumulated fatigue from four months of dollar depreciation. In such an environment, the market may be less sensitive to bad news for the dollar and overly sensitive to good news.

The FxPro Analyst Team