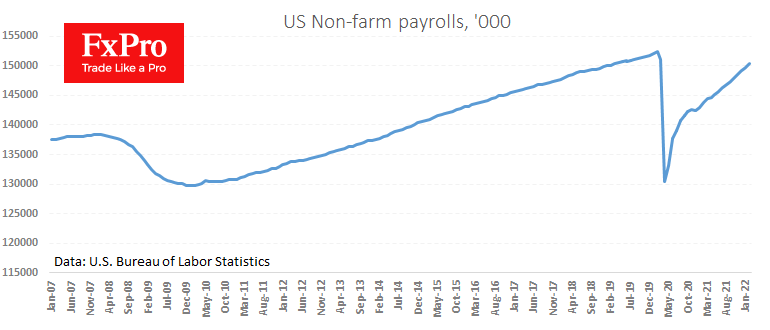

The US labour market added 678K jobs outside the agricultural sector in February. This is higher than the expected 400K. In addition, last month’s estimates were improved, which also adds strength to the fresh data.

Hourly earnings were virtually flat over the month, with year-on-year growth slowing to 5.1% vs. +0.6% and 5.5%, respectively.

The slowdown in wages while hiring accelerates seems due to the economy re-opening on the easing of coronavirus restrictions, which is bringing more low-paid workers back into the market.

The FxPro analyst team, mentioned, that the publication of the employment data accelerated the dollar’s gains, bringing it to 1.15% today and 2.4% so far this week. The EURUSD, which started the day near 1.1060, has slipped below 1.0900 at the time of writing, hitting lows since May 2020 and almost erasing the gains from the sharp pandemic phase.

Next, Europe, after the global financial crisis, could face a severe recession, which would increase the interest rate differential in the eurozone and the USA and encourage a flow of investors to the US dollar in addition to capital flows on the back of military action.

The FxPro AnalystTeam