US inflation once again beat expectations, causing markets to further discount the chances of an easing cycle starting in June.

The dollar responded with a 1% rise against a basket of major currencies, taking the DXY back to 104.80. The dollar recorded two peaks near these levels in February and late March, and it has not traded steadily higher since November.

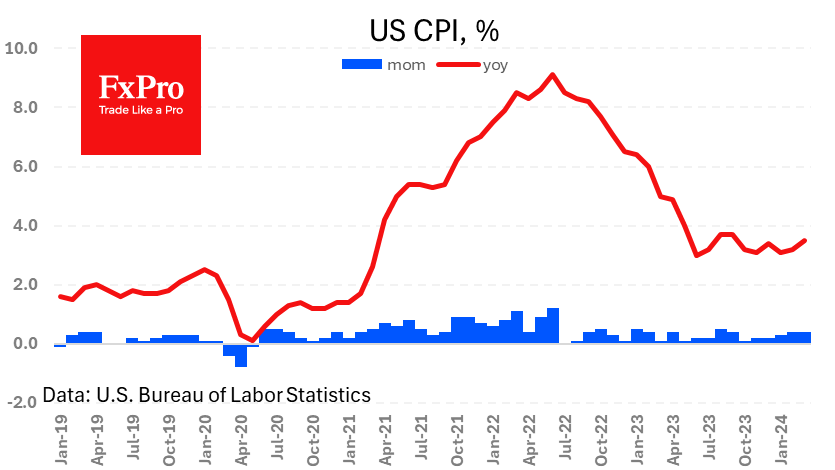

The general and core consumer price indexes each added 0.4% versus 0.3% expected. The annual rate of general inflation rose to 3.5%, while the core index maintained its 3.8% y/y pace. In both cases, the monthly rates of increase defy expectations of a return to the targeted 2%.

This should be troubling news on top of the strong employment report late last week. The data-linked Fed is unlikely to miss the data set of the past five days and is likely to maintain its wait-and-see stance.

Technically, the current upside momentum looks like an attempt to break away from support in the form of the 50 and 200-day moving average crossover and head higher after a prolonged consolidation. This movement may not meet any significant resistance until the 106.80-107 area, where the downward reversal was formed last October.

The FxPro Analyst Team