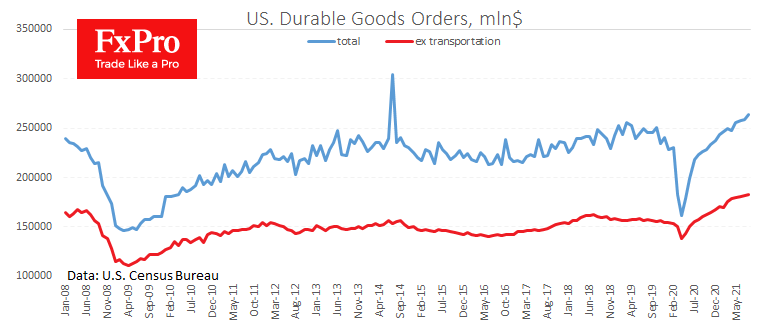

US Durable goods orders notably exceeded expectations (+0.7% m/m), adding 1.8% in August after rising 0.5% a month earlier. The rise here is a signal of confidence of US companies as they tend to reduce investments in high-value goods in a time of uncertainty.

However, it is worth noting that the rise in the overall figure was largely driven by a recovery in the transport sector. Without it, order growth for August was 0.2%, and companies are clearly skewing investment towards the transport sector, where prices have risen substantially due to component supply issues.

The strong orders data helps to cool fears that the US economy is slowing sharply just ahead of the unwinding of support from the US Federal Reserve. Technically, this is a bullish signal for the dollar and US markets. However, they may put their reaction “on pause” pending a decision on the infrastructure package and the government debt ceiling from lawmakers, which is expected later in the week.

The FxPro Analyst Team