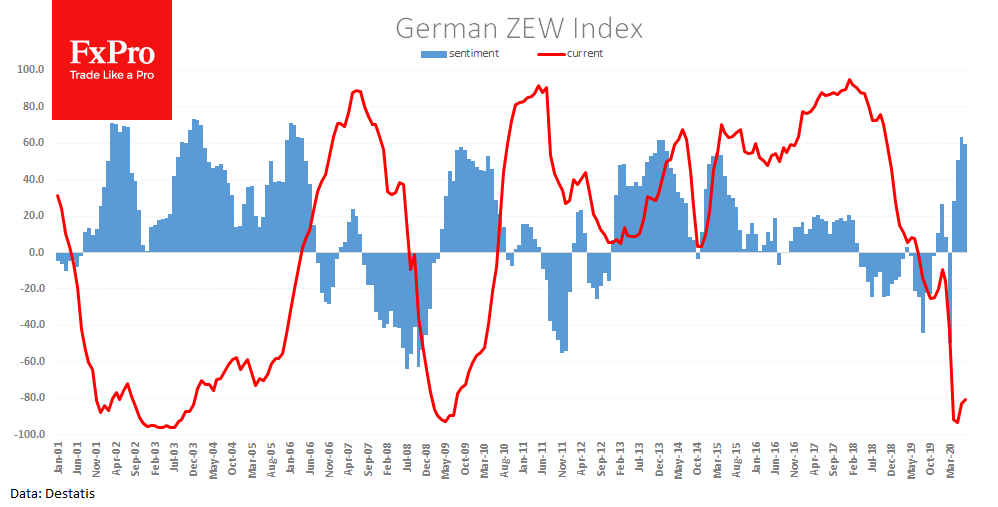

A study by the German ZEW institute noted an improvement in business sentiment. The ZEW index jumped to 71.5 in August from 59.6 a month earlier with expectations of a decline to 57.0. Thus, the rise in new coronavirus cases in Germany over the last month has not stopped the recovery of business sentiment.

The ZEW index is considered as an excellent leading economic indicator, so strong report contributed to the optimism in European stock markets today. German DAX is rising by 2.1% now, testing the round level of 13000. This strengthening is all the more remarkable as it coincides with the growth of the single currency. EURUSD found short-term support at 1.1720 earlier today, and strengthened after the ZEW release, now trading at 1.1800.

The report, however, left some bad taste in the mouth of investors. The index of the current situation assessment remains close to shallow levels. Simply put, the business sentiment strengthens the confidence of an improvement to conditions, but this remains to be seen.

The FxPro Analyst Team