Stocks gained on Tuesday as the formal go-ahead for U.S. President-elect Joe Biden to begin his transition added to an already brighter mood from progress made on COVID-19 vaccines and the prospects for a speedy global economic revival.

European markets appeared set to extend optimism in Asian and U.S. equities, with Euro Stoxx 50 futures and FTSE futures up 0.52% and 0.42%, respectively.

U.S. General Services Administration chief Emily Murphy wrote in a letter to Biden on Monday that he can formally begin the hand-over process.

President Donald Trump tweeted that he had told his team “do what needs to be done with regard to initial protocols”, an indication he was moving toward a transition after weeks of legal challenges to the election results.

U.S. stocks also got an added boost after reports that Biden plans to nominate former Federal Reserve Chair, Janet Yellen, to become the next Treasury Secretary. Futures for the S&P 500 rose 0.73% in afternoon Asian trade.

The upbeat backdrop helped MSCI’s broadest index of Asia-Pacific shares outside Japan advance 0.19% in the afternoon trade. Australia’s S&P/ASX 200 was 1.26 percent stronger, touching its highest level in almost nine months, with energy stocks leading the pack.

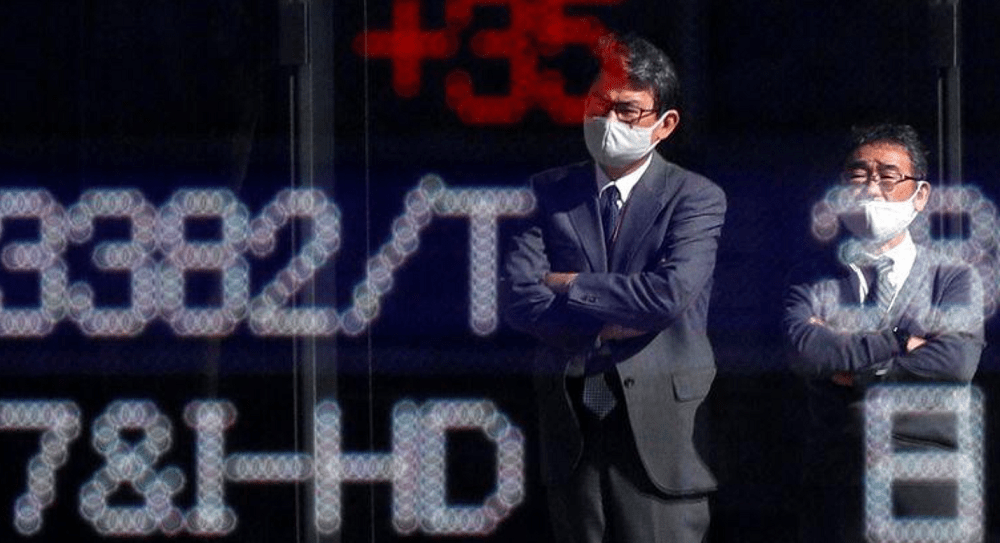

Japan’s Nikkei jumped 2.47%, after reaching 26,186.53 by 0204 GMT, its highest since May 1991, with energy, real estate and financial shares leading the advance. Seoul’s Kospi was 0.54% higher while Hong Kong’s Hang Seng was steady, up 0.03%.

Chinese blue-chips were an outlier, edging down 0.85%, as investors booked profits following recent strong gains.

The dollar index, which tracks the greenback against a basket of six major rivals, nudged down to 92.406 while the euro gained 0.11% on the day to $1.1853.

On Wall Street, the Dow Jones Industrial Average rose 1.12% overnight, the S&P 500 gained 0.56% while the Nasdaq Composite added only 0.22%, underperforming as traders rotated away from big tech names.

Oil prices added to last week’s gains as traders anticipated the vaccine news would spur a recovery in energy demand.

Stocks rise as investors cheer Biden transition, vaccine progress, Reuters, Nov 24