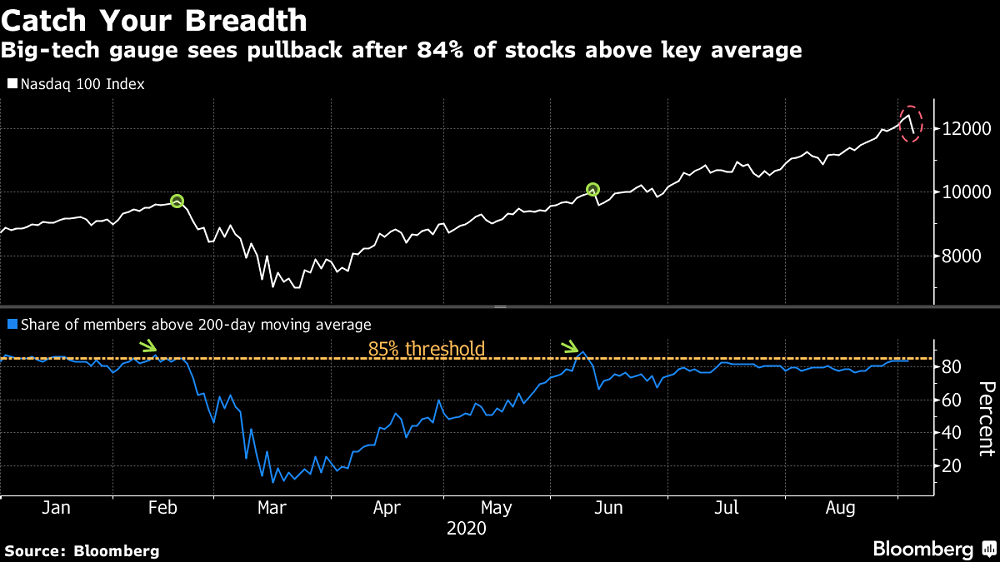

U.S. equities tumbled by the most in almost three months as the rotation away from high-flying tech stocks gained steam, with investors questioning the sustainability of lofty valuations. The S&P 500 Index retreated from a record high and was set for its biggest drop since June amid declines in Apple, Microsoft, Amazon and Facebook. The Nasdaq 100 fell more than 5% at one point, its biggest intraday decline since March. European stocks erased gains and finished more than 1% lower.

The Cboe Volatility Index — a measure of expected price swings for the S&P 500 Index known as Wall Street’s “fear gauge” — rose to the highest level since July. Bitcoin fell as much as 7.6%. Meanwhile, U.S. health officials have told states to prepare for a Covid-19 vaccine to be ready by Nov. 1, an aggressive goal that suggests availability just before the presidential election. Infectious disease expert Anthony Fauci warned of a potential surge in American cases from the coming long holiday weekend.

Stocks

The S&P 500 Index sank 3.4% as of 2:01 p.m. New York time.

The Stoxx Europe 600 Index fell 1.4%.

The MSCI Asia Pacific Index fell 0.3%.

The MSCI Emerging Market Index dipped 1%.

Currencies

The Bloomberg Dollar Spot Index climbed 0.2%.

The euro declined 0.1% to $1.1847.

The Japanese yen rose 0.1% to 106.04 per dollar.

Bonds

The yield on 10-year Treasuries fell three basis points to 0.62%.

Germany’s 10-year yield fell one basis point to -0.49%.

Britain’s 10-year yield rose less than one basis point to 0.23%.

Commodities

West Texas Intermediate crude declined 0.4% to $41.35 a barrel.

Gold fell 0.6% to $1,930.59 an ounce.

Stocks Post Biggest Rout Since June as Tech Sinks, Bloomberg, Sep 3