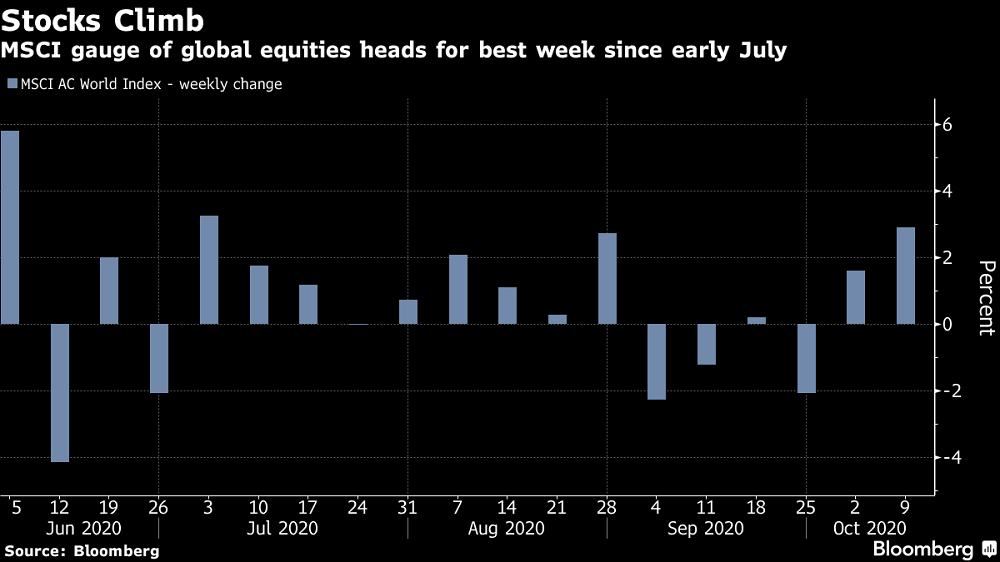

U.S. stocks rose for third day and global stocks headed toward their biggest weekly gain since July after the White House signaled an openness to large-scale stimulus and companies raised profit forecasts. Treasury yields and a dollar gauge slipped.

European stocks gained as a host of companies raised outlooks, from Denmark’s drugmaker Novo Nordisk A/S to German online clothing retailer Zalando SE. Stocks fell in Spain, where the government’s cabinet met to declare a state of emergency for Madrid to control Covid-19. Italy’s 10-year bond yield fell a record low.

Investors are winding up a volatile week with a mild risk-on attitude. With Trump recuperating from Covid-19 in the final stretch of the election campaign, they’re increasingly betting a Joe Biden victory is likely. Speculation is moving now to whether Democrats will sweep Congress too and then enact massive stimulus.

“Large-scale fiscal easing will push down the value of the U.S. dollar, while giving bond yields a modest boost,” strategists led by Peter Berezin at BCA Research wrote in a note. “Non-U.S. stocks will outperform their U.S. peers. Value stocks will outperform growth stocks.”

Elsewhere, Vanguard Group Inc. returned about $21 billion in managed assets to government clients in China as part of a global shift to focus on low-cost funds for individual investors, according to people familiar with the matter.

Oil in New York is poised for the biggest weekly gain since June with Hurricane Delta forcing operators to shut-in almost 92% of crude output in the Gulf of Mexico.

Stocks

The S&P 500 Index increased 0.6% to 3,466.11 as of 9:33 a.m. New York time, the highest in more than five weeks.

The Dow Jones Industrial Average rose 0.5% to 28,574.16, the highest in more than five weeks.

The Nasdaq Composite Index climbed 0.5% to 11,481.95, the highest in more than five weeks.

The Nasdaq 100 Index gained 0.5% to 11,606.94, the highest in five weeks.

The Stoxx Europe 600 Index increased 0.5% to 370.32, the highest in more than three weeks.

Currencies

The Bloomberg Dollar Spot Index declined 0.5% to 1,164.48, the lowest in three weeks on the biggest drop in six weeks.

The euro rose 0.5% to $1.1816, the strongest in three weeks.

The Japanese yen strengthened 0.2% to 105.78 per dollar, the biggest advance in more than three weeks.

Bonds

The yield on 10-year Treasuries fell less than one basis point to 0.78%.

The yield on 30-year Treasuries rose one basis point to 1.59%, the highest in more than four months.

Germany’s 10-year yield dipped one basis point to -0.53%, the lowest in a week.

Britain’s 10-year yield decreased one basis point to 0.28%, the lowest in a week.

Commodities

West Texas Intermediate crude declined 0.4% to $41.04 a barrel.

Gold strengthened 1.3% to $1,918.35 an ounce, the highest in three weeks on the biggest rise in six weeks.

Copper climbed 1.5% to $3.09 a pound, the highest in three weeks.

Stocks Gain as Stimulus Talks Take Center Stage, Bloomberg, Oct 9