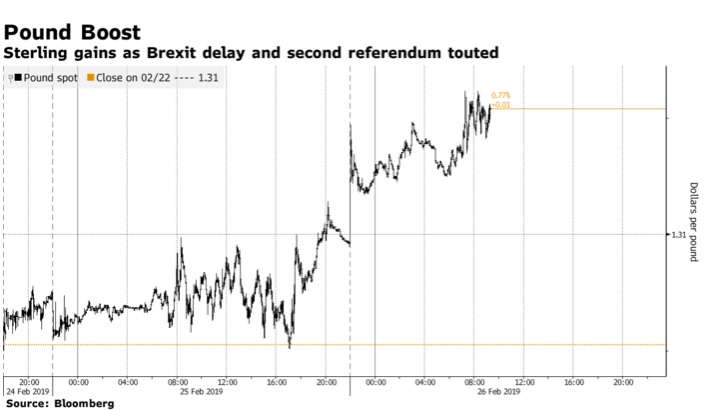

Stocks fell and bonds rose on Tuesday as the rush of optimism over U.S.-China trade talks from earlier in the week faded. The pound strengthened after U.K. Prime Minister Theresa May was said to be considering a plan to delay Brexit.

The Stoxx Europe 600 Index declined with most sectors in the red, while S&P 500 Index futures were lower after U.S. President Donald Trump raised the possibility of signing a new trade deal with Chinese counterpart Xi Jinping, but cautioned an agreement “might not happen at all.” Tesla fell as much as 5.4 percent in post-market trading after regulators asked a judge to hold Elon Musk in contempt for violating last year’s SEC settlement. Equities slipped throughout Asia and the yen strengthened. Treasuries rose with most European notes.

The Stoxx Europe 600 Index sank 0.5 percent as of 9:32 a.m. London time, the lowest in a week on the largest decrease in more than two weeks. Futures on the S&P 500 Index decreased 0.4 percent. The U.K.’s FTSE 100 Index sank 1.1 percent to the lowest in more than two weeks on the largest tumble in two months. Germany’s DAX Index sank 0.5 percent, the first retreat in more than a week. The MSCI Emerging Market Index fell 0.3 percent, the first retreat in more than a week. The MSCI Asia Pacific Index dipped 0.4 percent, the first retreat in more than a week.

The Bloomberg Dollar Spot Index climbed less than 0.05 percent. The euro advanced less than 0.05 percent to $1.1359, the strongest in almost three weeks. The British pound advanced 0.5 percent to $1.3156, the strongest in more than four weeks on the largest gain in a week. The Japanese yen climbed 0.2 percent to 110.85 per dollar, the biggest increase in more than a week.

Stocks Drop as Trade Optimism Fades; Pound Climbs, Bloomberg, Feb 26