Stocks dropped as an abrupt end to the U.S.-North Korea summit and disappointing manufacturing data out of China added to the woes facing investors. Havens, including gold and the yen, climbed.

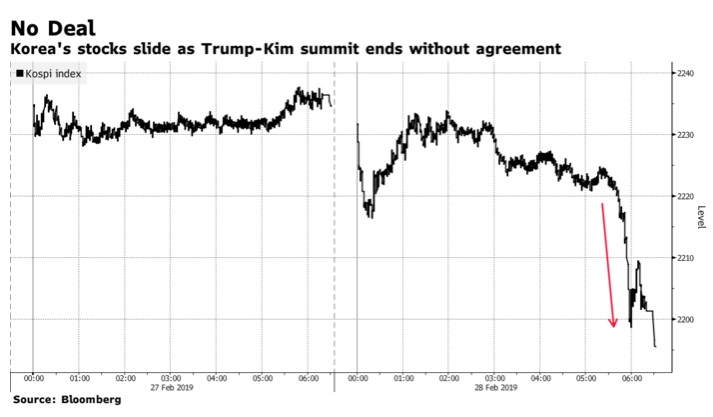

Miners led the drop in the Stoxx Europe 600 Index and copper declined after underwhelming Chinese manufacturing data underscored concerns about the global economy. Contracts on the Dow, Nasdaq and S&P 500 all fell, with South Korean shares the biggest losers in Asia as President Donald Trump and Kim Jong Un departed the summit venue in Hanoi without a deal on nuclear disarmament and sanctions. Treasuries climbed, most European bond slipped and the dollar held steady.

The Stoxx Europe 600 Index sank 0.4 percent as of 9:25 a.m. London time, the lowest in a week on the largest decrease in almost three weeks. Futures on the S&P 500 Index fell 0.3 percent to the lowest in a week on the biggest fall in a week. The MSCI Asia Pacific Index dipped 0.6 percent to the lowest in a week on the largest decrease in almost two weeks. The MSCI Emerging Market Index dipped 0.6 percent to the lowest in a week on the biggest decrease in almost two weeks.

The yield on 10-year Treasuries fell one basis point to 2.67 percent. Germany’s 10-year yield gained one basis point to 0.15 percent, the highest in more than three weeks. Britain’s 10-year yield dipped less than one basis point to 1.27 percent.

Stocks Dip as Korea No-Deal, China Data Disappoint, Bloomberg, Feb 28