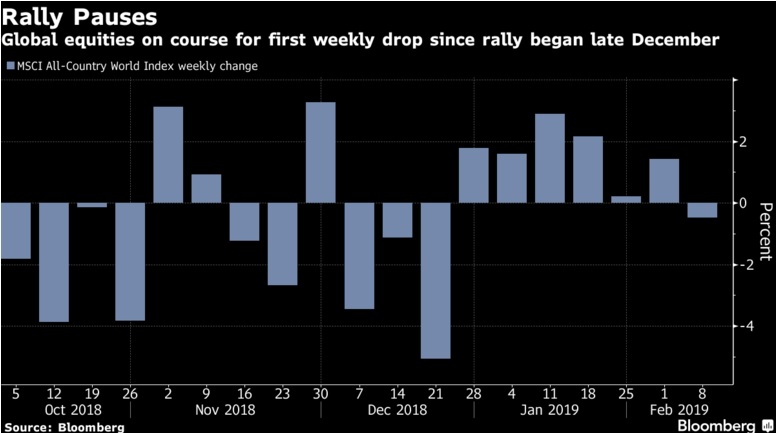

Stocks fell and bonds ticked higher as concern over economic growth and trade disputes sent global equity markets toward their first weekly loss since December. Oil and most industrial metals dropped, while the yen nudged higher.

The Stoxx Europe 600 Index was dragged lower for a second day by automakers and technology shares. Stocks tumbled in much of Asia along with U.S. equity futures following news that President Donald Trump is unlikely to meet Chinese President Xi Jinping before the March 1 deadline for more tariffs, re-igniting fears over further protectionist measures. Japanese shares led declines in Asia, and Hong Kong stocks pared an early slide as trading resumed after a three-day holiday. China’s markets remain shut for Lunar New Year.

Investors are calling for a time-out on the risk rally that began around Christmas as central banks and governments from Brussels to Sydney cut growth forecasts. The European Commission made sweeping downward revisions to most of the region’s major economies Thursday and the Bank of England said it expected the U.K. economy to grow at its slowest pace in a decade. The Reserve Bank of Australia lowered its growth and inflation forecasts Friday.

The Stoxx Europe 600 Index fell 0.1 percent as of 8:09 a.m. London time. Futures on the S&P 500 Index fell 0.4 percent. The MSCI World Index of developed countries fell 0.2 percent to the lowest in more than a week. The MSCI Asia Pacific Index decreased 1 percent.

Stocks Fall on Pessimism Over Trade; Bonds Edge Up, Bloomberg, Feb 08