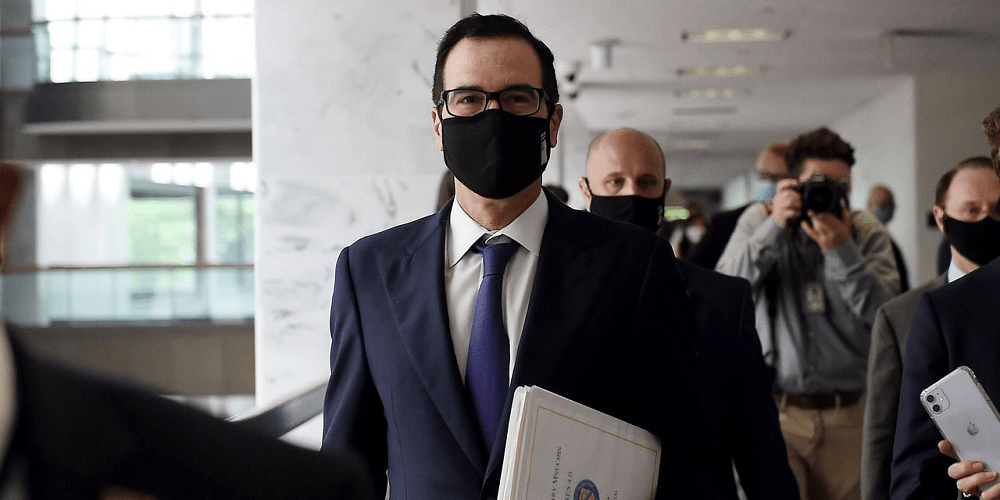

Stocks climbed on speculation that talks about a new round of economic stimulus will resume. The S&P 500 rose on a news report that Treasury Secretary Steven Mnuchin plans to resume negotiations with House Speaker Nancy Pelosi. He told a Senate Banking Committee hearing on Thursday that a targeted pandemic relief package is “still needed.” The U.S. economy may be close to a “full recovery” by year’s end, Federal Reserve Bank of St. Louis President James Bullard said. Tech companies and retailers led the advance in equities, following an early rout that took the gauge 10% below its September high.

Federal Reserve Chairman Jerome Powell reiterated that “it’s likely that additional fiscal support will be needed,” speaking at the same Senate panel where Mnuchin was testifying.

Stocks

The S&P 500 advanced 0.8% at 12:06 p.m. New York time.

The Stoxx Europe 600 Index decreased 1%.

The MSCI Asia Pacific Index dipped 1.8%.

Currencies

The Bloomberg Dollar Spot Index gained 0.1%.

The euro fell 0.1% to $1.1654.

The Japanese yen depreciated 0.1% to 105.46 per dollar.

Bonds

The yield on 10-year Treasuries dipped one basis point to 0.67%.

Germany’s 10-year yield decreased less than one basis point to -0.51%.

Britain’s 10-year yield was unchanged at 0.218%.

Commodities

West Texas Intermediate crude decreased 0.1% to $39.90 a barrel.

Gold strengthened 0.2% to $1,867.22 an ounce.

Silver depreciated 1% to $22.54 per ounce.

Stocks Climb on Mnuchin’s Remarks Amid Tech Rally: Markets Wrap, Bloomberg, Sep 24