Equities rose globally alongside U.S. index futures after President Donald Trump said he’s considering a tax cut on capital gains. Gold slipped for a third day.

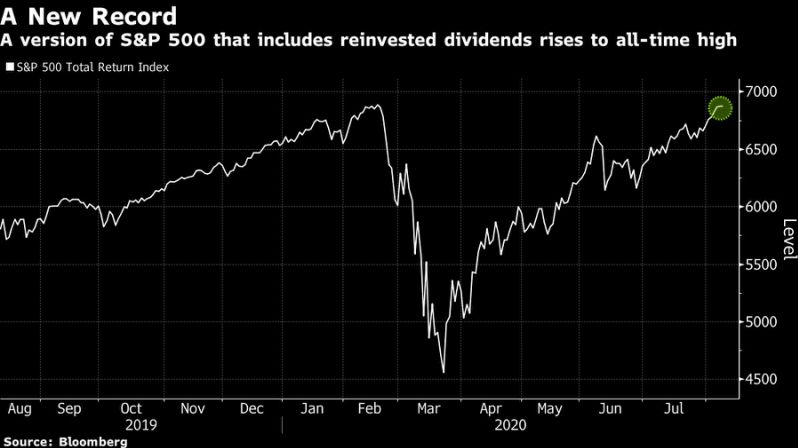

From carmakers to energy stocks, a broad rally swept the Stoxx Europe 600 Index higher. Momentum carried forward from Asia, where a benchmark gained the most in a week, and from the U.S., after coronavirus hospitalizations fell in the most populous states even as global cases topped 20 million. S&P 500 and Nasdaq 100 futures rose, putting the benchmark on course to approach its all-time high from February.

The dollar slipped after just two days of gains against its major peers. The euro gained versus the greenback before the release of Germany’s ZEW survey. Treasuries and core European bonds edged lower. The risk-on sentiment weighed on gold.

Investors are taking some comfort from Trump’s comment on potential tax cuts, strong Chinese economic data and falling hospitalizations in California and New York. Looking past the accelerating rate of global infections, they’re driving a global stocks benchmark toward erasing its 2020 loss today.

Stocks

The Stoxx Europe 600 Index gained 1.8% as of 9:45 a.m. London time.Futures on the S&P 500 Index climbed 0.6%.Germany’s DAX Index gained 2.3%.The MSCI Asia Pacific Index advanced 1.1%.

Currencies

The Bloomberg Dollar Spot Index declined 0.1%.The euro advanced 0.2% to $1.1765.The British pound climbed 0.1% to $1.308.The Japanese yen weakened 0.2% to 106.15 per dollar.New Zealand’s dollar jumped 0.3% to $0.6614.

Bonds

The yield on 10-year Treasuries gained two basis points to 0.59%.The yield on two-year Treasuries climbed less than one basis point to 0.13%.Britain’s 10-year yield advanced three basis points to 0.156%.Germany’s 10-year yield increased one basis point to -0.51%.

Commodities

West Texas Intermediate crude gained 1.2% to $42.45 a barrel.Gold weakened 2% to $1,987.43 an ounce.Silver weakened 3.7% to $28.06 per ounce.LME zinc decreased 0.4% to $2,388 per metric ton

Stocks Climb Globally While Dollar Slips With Gold: Markets Wrap, Bloomberg, Aug 11