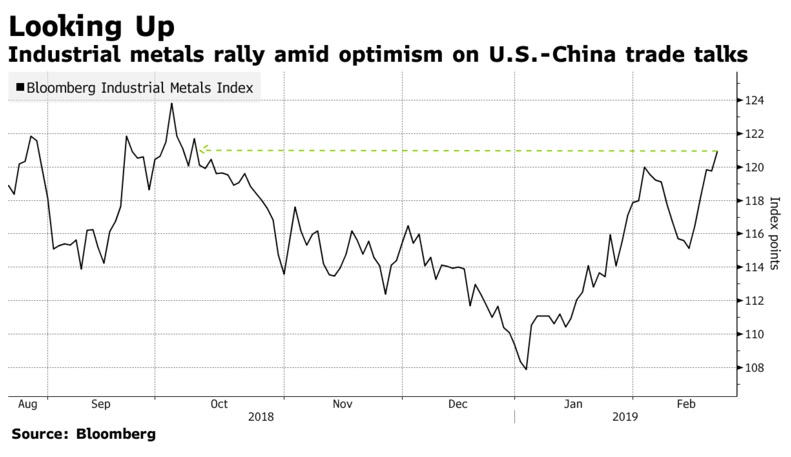

Stocks gained in Europe along with U.S. equity futures on Friday after a mixed session in Asia as investors awaited results from top-level trade talks between America and China. Treasuries posted a modest advance. Mining and technology shares led the advance in the Europe Stoxx 600 Index as Bloomberg’s industrial-metals subindex headed for its highest level since October. Futures on the Dow, S&P 500 and Nasdaq Composite indexes all climbed, even as Kraft Heinz Co. plunged in pre-market trading after announcing a $15.4 billion writedown late Thursday. Emerging-market stocks rose for a fifth day, the longest streak since May, and a gauge of smaller Chinese stocks entered a bull market. Japanese shares slipped.

The euro erased a gain after data showed that confidence in Germany’s economy, Europe’s largest, fell to a four-year low in February, with traders now awaiting European Central Bank President Mario Draghi’s a speech later Friday. The dollar and gold were flat, while West Texas oil traded rose above $57 a barrel in New York.

The Stoxx Europe 600 Index advanced 0.2 percent as of 10:32 a.m. London time. Futures on the S&P 500 Index advanced 0.3 percent, the biggest gain in a week. The MSCI Asia Pacific Index rose 0.1 percent. The MSCI Emerging Market Index rose 0.4 percent. The Shanghai Composite Index jumped 1.9 percent to 2,804.23, the highest in 21 weeks.

Stocks, Bonds Advance Before U.S.-China Meeting, Bloomberg, Feb 22