Stock investors focused on new worries about the coronavirus and economy, selling into a market Monday that was already technically shaken and set for further declines. But Monday’s sharp sell-off was different than the September slump that has centered on tech and growth stocks. Instead it was led by the cyclical names that had been gaining on expectations for a recovering economy, and not so much by the frothy growth names that have been correcting.

“Things had to have changed for investors to be so nervous,” said Sam Stovall, chief market strategist at CFRA. “With Europe starting to see a sharp increase in Covid cases, does that mean they ’re going to reimpose shutdowns?” The U.K. government’s top scientists warned the country could expect to see almost 50,000 new coronavirus cases per day in mid-October if no action is taken.

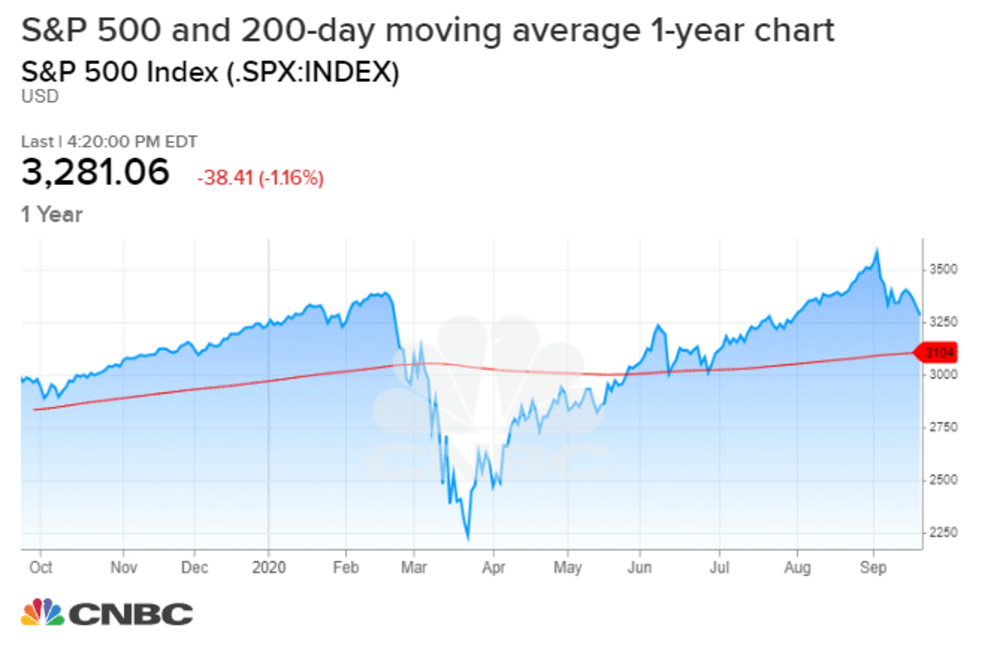

Technical analysts say the market has seen a breakdown that could take the S&P 500 to its 200-day moving average at 3,104 or even lower. The S&P 500 was already down more than 7% from its early September high as of the closing bell Friday. After a sharp sell-off during the trading day, the major indexes recovered much of their losses into the close, with the Dow off 1.8%. The S&P 500 was down 1.2% at 3,281, and tech-heavy Nasdaq, which had been leading the selling previously, was off just 0.1%. The Nasdaq was helped by a recovery in Apple and Amazon.

Apple, already in a 20% bear market decline, found its footing Monday and was slightly higher, as was Tesla. Strategists had expected tech to be a battleground in the market this week, with dip buyers looking for opportunities to buy the market favorites.

As for major sectors, materials were the hardest hit, followed by energy and industrials, all more than 3% lower. They were followed by financials, off about 2.5%. Airlines were down 7%. Tech turned positive, and was up 0.7% in the final hour, after being down most of the day. Communications services, including Alphabet and Facebook, was down 1.2%.

Fundstrat technical analyst Rob Sluymer said he expects as bottom to be formed by October, and the market could see a move higher into the election. He said there are signs that tech stocks are ready for a bounce for a period, but then they and the market could continue to be choppy.

Stock sell-off accelerates and is expected to get worse before it gets better, CNBC, Sep 22