The stock market turbulence could be a setup for a post-election rally. The roughly 2% decline in stocks Monday came amid new worries about the coronavirus, as average daily cases hit a record high in the U.S. At the same time, the efforts between Congress and the White House to reach a stimulus deal also appeared to have hit a wall.

“It’s a bit of a double whammy. Covid’s definitely not going in the right direction in the U.S. right now. I think now there is maybe some diminishing optimism because stimulus just hasn’t come together, and the election is just around the corner,” said Tom Lee, head of research at Fundstrat Global Advisors. “I think the polling is kind of solidifying. It’s looking very much like a Biden White House and then for policy, if it’s a Biden win, there’s a chance the incumbent administration just dawdles on stimulus. That would really dampen markets into the new year.”

But Lee and other strategists said this week may be rocky for stocks, but once the election is over, the market is likely to bounce in a relief rally no matter who wins, as long as the winner is clear.

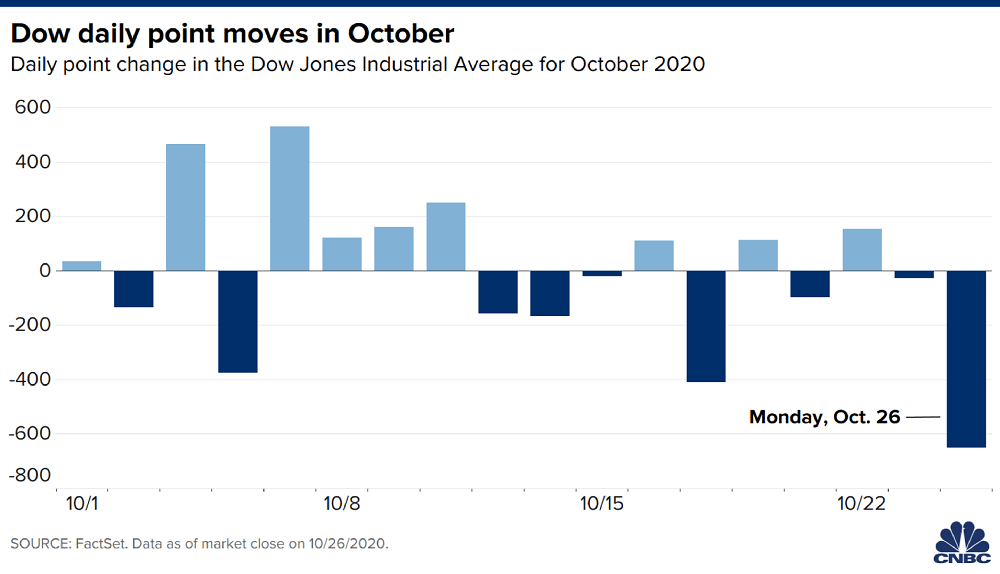

Stocks sold off out of the gate Monday, with the Dow down more than 3% at one point. The Dow recovered its worse losses and closed down 2.3% at 27,685, while the S&P 500 fell 1.9% to 3,400. The decline was led by energy, industrial stocks and other cyclicals.

“With the increase of cases in the U.S. and Europe, it’s just reminding everybody, the virus is still very much with us, and not going away any time soon, and with the weather getting colder and people moving inside, it’s likely to get worse before it gets better,” said Ed Keon, chief investment officer at QMA. “I think it’s unlikely to be the beginning of a major sell-off,” said Keon. “I still think underlying fundamentals for companies are quite good. If you look at earnings season, it’s been pretty promising.”

Barry Knapp, managing partner at Ironsides Macroeconomics, said the market may also be reflecting concern about a possible victory by former Vice President Joseph Biden. Biden’s ability to implement his policies will be determined by whether Democrats also take a majority of seats in the Senate, now a close call.

Topping Biden’s agenda is a reversal of Republican tax cuts, which essentially would raise taxes on corporations and the wealthy. He is also expected to push a stimulus program, the size of which would be subject to whether the Senate is controlled by Democrats. Biden is leading President Donald Trump by 7.8 percentage points in an average of major polls, according to RealClearPolitics.

Stock market turbulence could last until the election, followed by a relief rally, strategists say, CNBC, Oct 27