Futures contracts tied to the major U.S. stock indexes held steady in early morning trading on Thursday, hours after the Nasdaq Composite clinched its 25th record close for 2020. Dow Jones Industrial Average futures dipped 22 points, implying an opening move around the flatline when trading resumes on Thursday. S&P 500 and Nasdaq-100 futures pointed to similar muted action Thursday morning.

The after-hours moves Wednesday evening followed a positive regular session on Wednesday, with the major indexes brushing off a record daily increase in new U.S. Covid-19 cases. Big Tech continued to carry the broader market higher on during regular trading and again allowed the Nasdaq Composite to outpace the S&P 500 and Dow industrials.

The Nasdaq rose 1.44% between a 2.3% rally in Apple, a 2.7% rise in Amazon and a 3.49% climb in Nvidia. The index closed at a record high 10,492.50. The S&P 500 notched a more modest 0.78% gain on Wednesday while Microsoft and Goldman Sachs helped push the Dow up 177 points, or 0.68%

Since last week’s close, the S&P 500, Dow and Nasdaq Composite are up 1.28%, 0.93% and 2.79%, respectively. The Nasdaq is up 29.68% over the last three months. The latest iteration of the Labor Department report on weekly jobless claims will be released Thursday morning. The weekly figures provide Wall Street with critical insight on how many Americans continue to collect unemployment benefits, known as continuing claims.

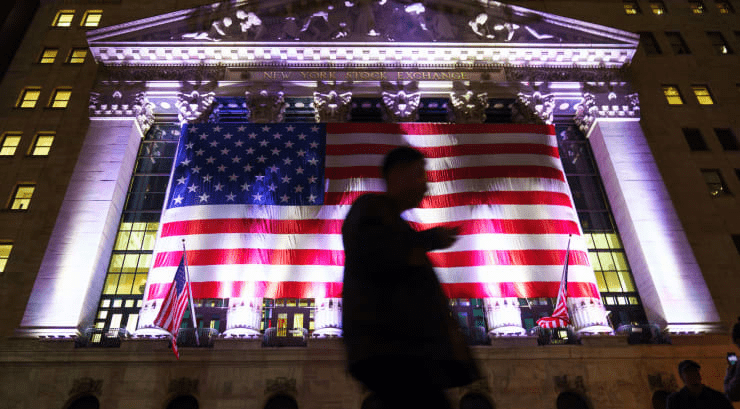

Stock futures little changed after Nasdaq clinches new record, CNBC, Jul 9