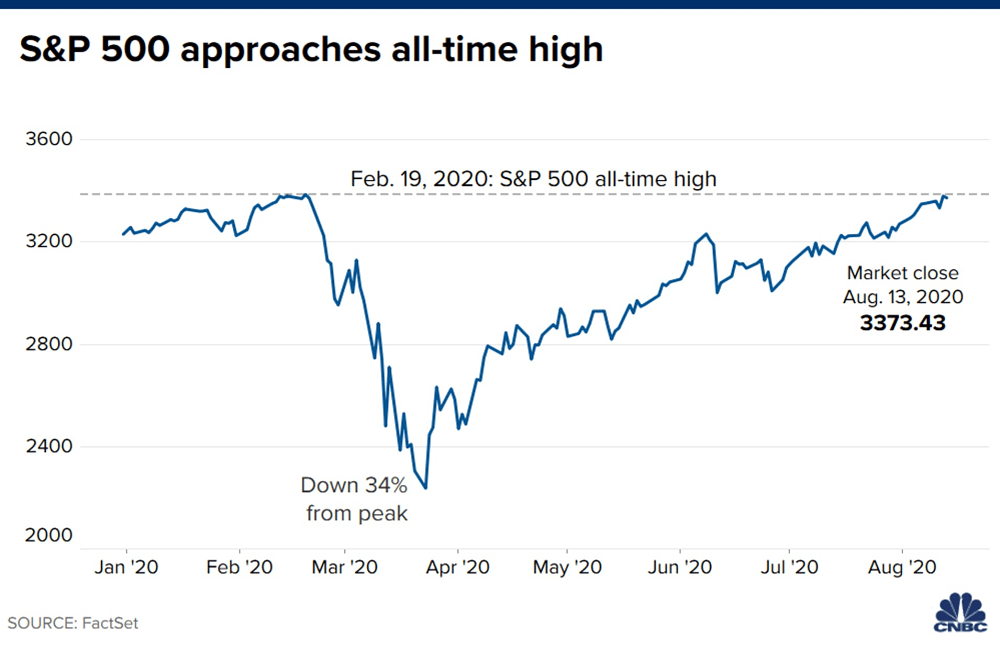

U.S. stock futures retreated early Friday morning as the S&P 500 struggles to break past its record high from February. Dow Jones Industrial Average futures fell 119 points, or 0.4%. S&P 500 futures lost 0.2%. Nasdaq 100 futures were flat.

Airlines and cruise operators — two groups that would benefit from the economy reopening — slid in premarket trading. United Airlines dipped 0.8% and Delta was down 0.9%. American Airlines pulled back 1.4%. Norwegian Cruise Line and Carnival dropped 1.4% and 2.2%, respectively.

The S&P closed Thursday’s session down 0.2%. Earlier in the day, it briefly traded above its record closing high of 3,386.15. The gyrations between gains and losses through the day came as tech shares outperformed while names that would benefit from the economy reopening struggled.

Facebook, Netflix and Alphabet all closed higher and Apple rallied to an all-time high. Meanwhile, Gap and American Airlines both fell at least 1.8%. JPMorgan Chase slid 0.6%.

If the S&P 500 breaks out for a fresh record, it would be the index’s fastest recovery from a 30% drop in its history, according to data compiled by Ned Davis Research. The S&P 500 remained 0.7% higher for the week despite Thursday’s decline. The broader market index has rallied more than 50% from an intraday low set March 23.

Stock futures fall as S&P 500 struggles to reach February record high, CNBC, Aug 14