U.S. stock futures were lower early Tuesday morning after a volatile day on Wall Street that saw the Dow Jones Industrial Average erase a 400-point deficit. Futures contracts tied to the Dow were lower by 167 points, while the S&P 500 futures sat below the flatline. Nasdaq 100 futures were also in mildly negative territory.

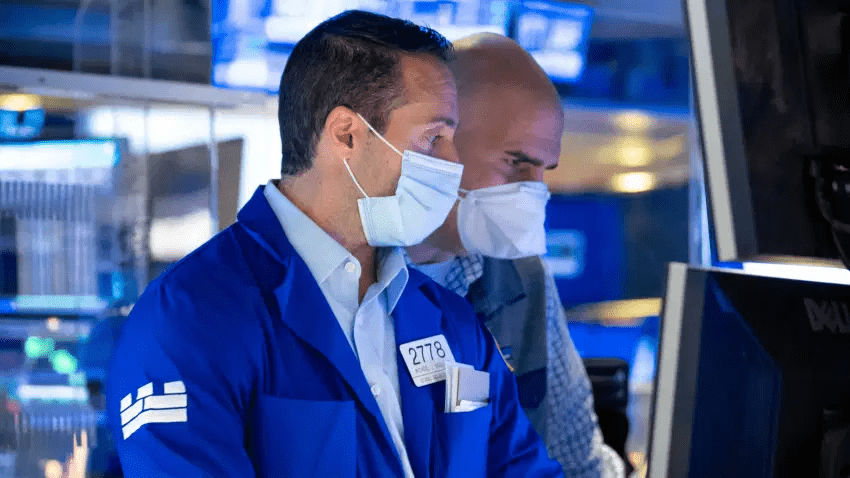

The muted move in futures came as Congress on Monday night passed a coronavirus relief and government spending package. The bill now goes to President Donald Trump’s desk. During Monday’s regular market hours, stocks opened sharply lower amid concerns about a new variant of Covid-19 in the United Kingdom. Many European countries implemented travel restrictions on visitors from the U.K., and New York Gov. Andrew Cuomo called for the United States to take similar steps.

However, many experts, including those from the World Health Organization, said on Monday that the coronavirus vaccines from Pfizer and Moderna would likely be effective against the new variant and that Covid was mutating at a slower pace than the seasonal flu. The Dow finished with a gain of 37 points, thanks in part to a strong performance bank stocks. The S&P 500, Nasdaq Composite and stocks tied to the travel industry finished well off their session lows.

Monday was also the first trading day where Tesla was a member of the S&P 500. The electric vehicle stock shed 6.5%, with part of that loss coming after Reuters reported that Apple was targeting 2024 as a date to introduce its own passenger vehicle. On the economic data front, investors will receive new readings on consumer confidence and existing home sales on Tuesday.

Stock futures down as Congress passes Covid relief bill, CNBC, Dec 22