U.S. equity futures advanced with European stocks as markets built upward momentum after the September selloff cut valuations. Gold slipped below $1,900 an ounce. Futures on the Dow Jones Industrial Average outperformed those on the Nasdaq 100 as bulls showed more interest in value and cyclical stocks. Tesla Inc. fell in the premarket after the carmaker’s presentation disappointed investors.

Treasuries steadied before Federal Reserve policy makers speak in Washington. Sterling sank to a two-month low after a U.K. official wouldn’t rule out a second British lockdown. A gauge of the dollar broke above a key technical resistance level and continued up.

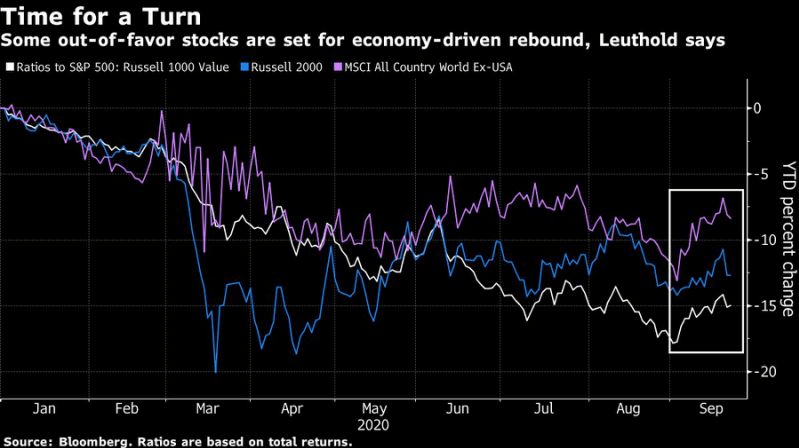

With global stocks still on track for their first monthly drop since March, investors are parsing economic news and less dovish comments from some Fed officials to determine whether September’s correction in valuations has gone far enough. Risks from a resurgence of coronavirus, and new measures to contain it, to the potential of a contested U.S. presidential election could spark more volatility.

Stocks

Futures on the S&P 500 Index increased 0.6% as of 6:54 a.m. New York time.Nasdaq 100 Index futures climbed 0.5%.The Stoxx Europe 600 Index gained 1.4%.The MSCI Asia Pacific Index rose 0.2%.

Currencies

The Bloomberg Dollar Spot Index increased 0.1%.Sterling weakened 0.1% to 92.01 pence per euro.The Japanese yen depreciated 0.1% to 105.01 per dollar.The Mexican peso weakened 0.7% to 21.8508 per dollar.

Commodities

West Texas Intermediate crude climbed 0.4% to $39.95 a barrel.Gold weakened 0.3% to $1,893.89 an ounce.Silver weakened 3% to $23.67 per ounce.Iron ore dipped 2% to $111.75 per metric ton.

Stock Futures Bounce Back; Gold Dips Below $1,900: Markets Wrap, Bloomberg, Sep 23