Amid a continuing deadlock over the most important matters at hand, there’s little chance that Congress will pass economic stimulus before the Nov. 3 election, according to Goldman Sachs. Less than two weeks before Election Day, chief negotiators for their respective parties remain at an impasse over key matters such as aid to states and business liability protections. Though talks headed by Treasury Secretary Steve Mnuchin and House Speaker Nancy Pelosi could continue right up until the vote, Goldman said the likelihood of an agreement is fading.

“Some of the biggest issues remain unresolved and a deal doesn’t seem particularly close,” Goldman economist Alec Phillips said in a note for clients. “With big differences and little time, it seems unlikely that Pelosi and Mnuchin will reach a deal before the election. More importantly, even if a deal in principle is announced in coming days — this seems possible, but not likely — it looks very unlikely that it would pass before Election Day.”

Financial markets have risen and fallen as the talks have taken multiple twists. The White House and congressional Democrats have been wrangling over the issue since the expiration of the $2.2 trillion CARES Act adopted in March to help an economy battered by the coronavirus pandemic. Republicans are looking for a smaller deal that would focus more on payment to individuals and business loans. Democrats are pushing for a more encompassing measure that would provide funding to state and local governments and reinstitute payments of $600 a week above what displaced workers normally would get in unemployment insurance.

Phillips noted progress made in some smaller areas like testing and contact tracing of individuals who have contracted Covid-19. However, state aid and protections for businesses remain contested “and there is no indication that differences have narrowed since last week,” Phillips wrote. If no bill is passed by the election, the result will then determine what the final aid package looks like, he added.

Should President Donald Trump defeat Joe Biden, the current bill probably would get through in a lame duck session prior to the new Congress being seated in January, Phillips said. Should Biden win and the Democrats take control of both chambers in Congress, there would be less incentive for them to push through a bill now. Goldman’s economists project that the Paycheck Protection Program could be funded in a piecemeal bill that also could entail expanded jobless benefits. Otherwise, “congressional Democrats would have little incentive to pass a scaled-down bill when they could pass a much larger bill in early 2021,” Phillips said.

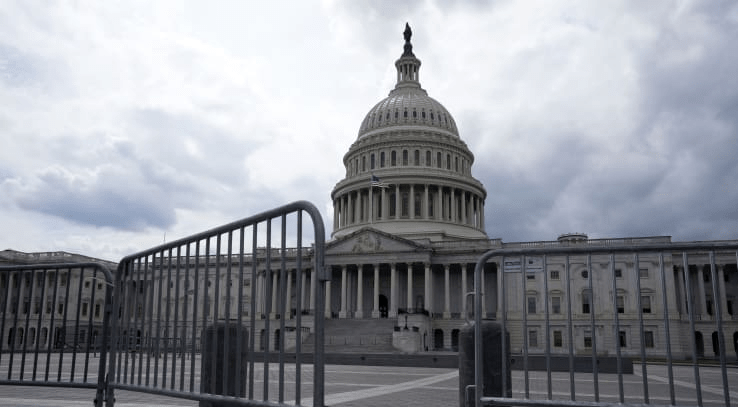

Stimulus package is unlikely to get through Congress before the election, Goldman Sachs says, CNBC, Oct 21