Demand for risk assets continues to cautiously recover in global markets this week. The S&P500 and Nasdaq100 indices rose almost 0.8% on Wednesday, and futures on these indices are adding another 0.6% during Asian trading. Futures on the Nikkei225 are rising in line with the US indices.

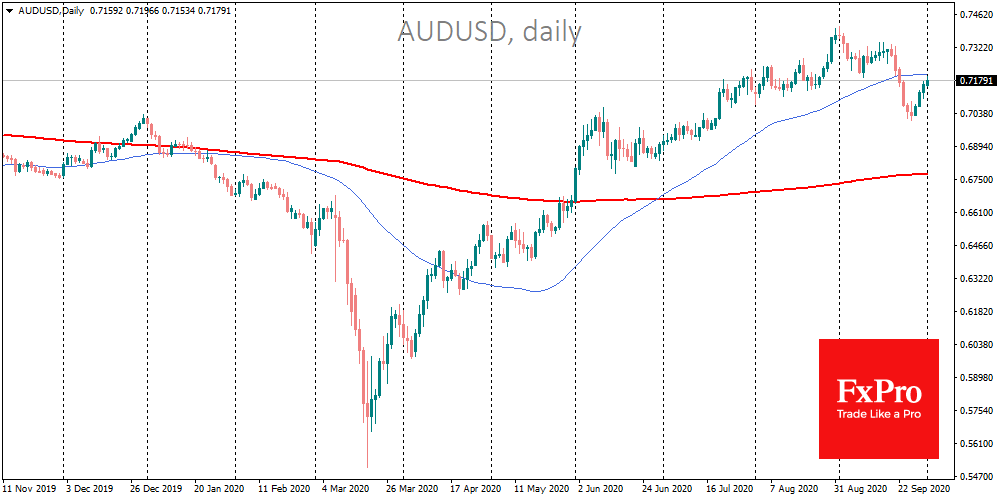

The Australian market, which reflects investor sentiment towards China, is showing impressive growth. The ASX200 is now adding 1% despite a 0.3% increase in the Aussie, which further increases investor returns. AUDUSD is adding for the fourth consecutive day, reaching 0.7180, returning approximately half of its losses of a drop from 0.7415 to 0.7005 earlier in September.

Offshore Chinese Yuan rose sharply to 6.73 per dollar, the highest level since May 2019, with a robust 2-day move. The USDCNH correction rollback proved to be short and shallow. Recent estimates of the PMI helped to regain interest in the CNY, which noted further strengthening of business activity in manufacturing and services at the fastest pace we have seen in multiple years.

The main reason for this acceleration in the second world economy is massive infrastructure projects to compensate for the downturn caused by the economic shutdown due to coronavirus and falling exports.

The world’s largest economy, and its markets, also depend on external help, another round of which is going through US legislation. In response to the $2.2 trillion support package from the Democrats, the counteroffer package from representatives of the Trump administration cost $1.5 trillion. This is significant progress in negotiations. As real figures have already emerged, positive sentiment remains in the markets. However, observers note that the parties are still far from signing the law.

Discussions on a package of measures in the US are becoming a prime driver for markets. Progress in the negotiations promises to push stock indices upwards and bring back pressure on the dollar after the September growth attempt. The renewal of local lows in the USDCNH pair may herald a broader weakening of the dollar index and precede a retest of EURUSD levels above 1.2000. At the same time, GBPUSD may very soon exceed 1.3000, potentially targeting local highs at 1.3500.

The FxPro Analyst Team