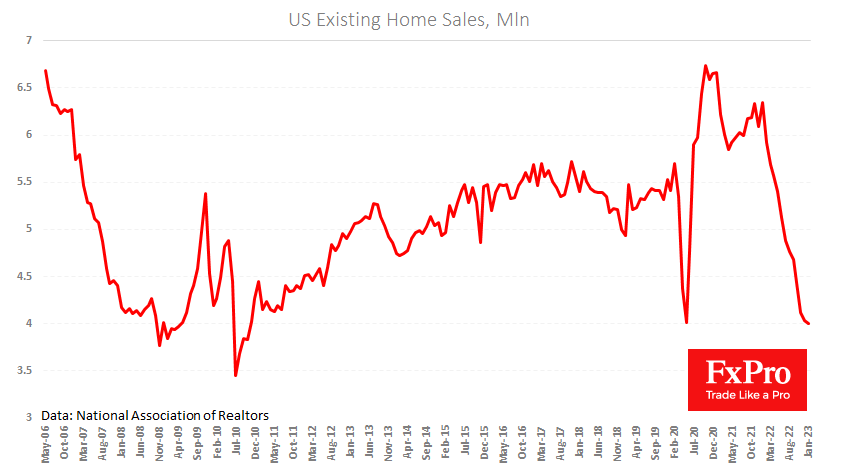

US existing home sales fell by 0.7% to 4.0 million in January. Although this is a nominal decline, it was the 12th consecutive month of falling sales. Sales fell below the pandemic low and were the lowest since October 2010, a period of the severe mortgage crisis.

The likely reasons for this are the previous excess sales, which were boosted by generous government support programs and the Fed’s ultra-low interest rates. Another factor putting pressure on the markets is prices: the median sales price in January 2023 was 359k, compared with 354.3k a year ago, but 28% higher than in March 2020.

The housing sector often acts as a leading indicator for the economy. It now points to a declining consumer confidence that could spread further across the economy. This impact promises to intensify as house prices fall.

The FxPro Analyst Team