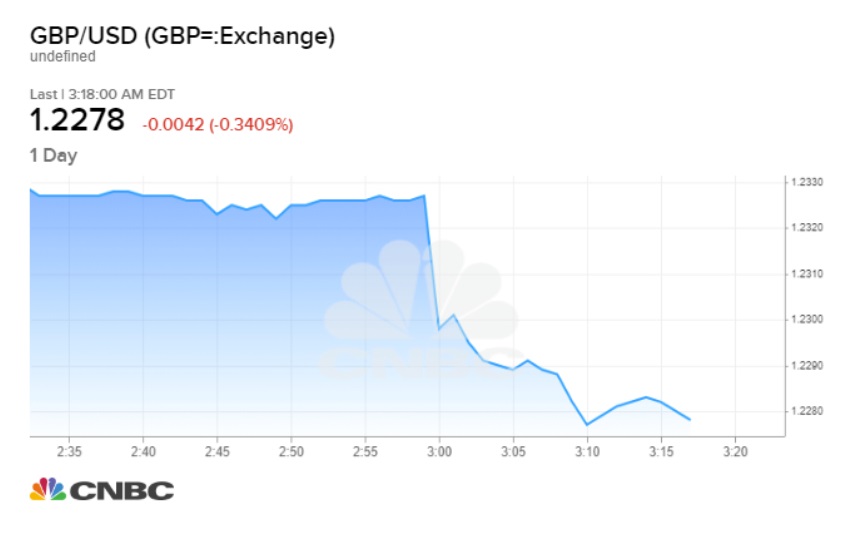

Sterling slipped below $1.23 against the dollar after a Bank of England policymaker said the next move for the central bank could be a rate cut. Speaking to local businesses in Northern England, Bank of England policymaker Michael Saunders said the U.K. could be looking at an interest rate cut if uncertainty around Brexit continues to persist.

“If the U.K. avoids a no-deal Brexit, monetary policy also could go either way and I think it is quite plausible that the next move in Bank Rate would be down rather than up,” Saunders said Friday, according to Reuters. The British currency slipped more than 0.4% against the dollar on the back of these comments to trade at $1.228. Sterling is down more than 3% since the start of the year and is down more than 1% since the U.K. voted to leave the European Union in June 2016.

Last week, the Bank of England held interest rates steady but warned that another delay to Britain’s departure date could lead to further economic weakness. “It is possible that political events could lead to a further period of entrenched uncertainty about the nature of, and the transition to, the United Kingdom’s eventual future trading relationship with the European Union,” the bank said in a press release. Saunders, meanwhile, said that even if a no-deal Brexit was avoided, the levels of uncertainty surrounding Brexit would continue to act as a kind of “slow puncture” for the British economy.

Central banks around the world have been easing their monetary policies in the wake of low inflation, slow growth and a looming recession. Earlier this month, the U.S. Federal Reserve announced it would cut interest rates to a target range of 1.75% to 2% but offered few indications that further reductions would follow over the coming months. The European Central Bank cut its main deposit rate by 10 basis points to -0.5%, a record low but in line with market expectations.