The S&P500 is consolidating above important technical and psychological levels, which could herald further gains in stock markets.

The peak of fear in the markets due to the military action in Ukraine came on March 7-8. After that date, we saw strong recovery momentum in European equity indices over the next nine days, after which the DAX40 and EuroStoxx50 were stuck in a sideways.

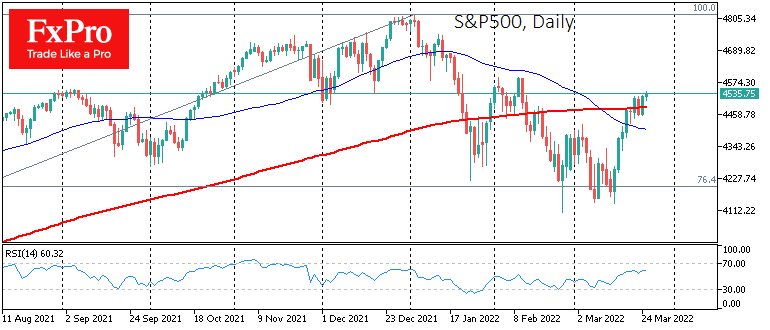

The US market did not fall as sharply as the European market at the outbreak of hostilities, but the recovery rally also came with a different delay. The S&P500 managed to bounce back from local lows only on March 15, after falling 15% from its peak at the beginning of the year. After that, we saw a rally of 9.5%.

The powerful intraday movement of the S&P500 got its footing above the 50-day average last Friday. This week, buyers pushed the index above the 200-day average, a stronger bullish signal. On Wednesday, the sellers tried to lower the index, consolidating the bearish trend, but the market closed above that significant line again at the end of Thursday. S&P500 futures added 0.3% by early trading in New York, confirming the bullish sentiment.

The index also closed Thursday above the round level 4500, which promises to attract attention for more buying in the coming days.

The FxPro Analyst Team