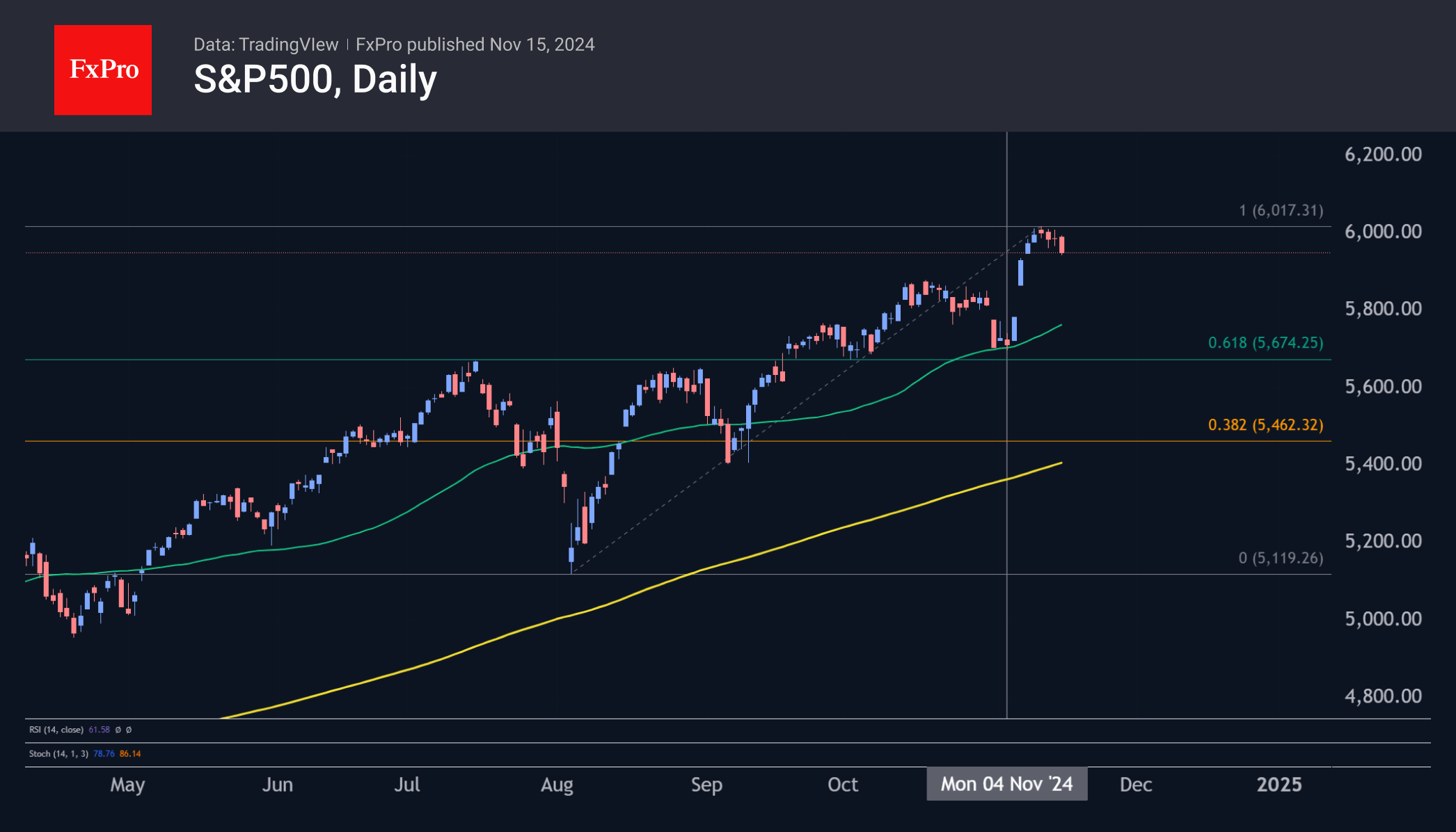

The US S&P500 hovered close to 6000, a new psychologically important level. In the second half of the week, the market’s momentum needed to be clearer. This was due to both fatigue from the 5% rally from the lows of the 4th and the steady appreciation of the dollar.

Later in the week, the pullback in US indices intensified as investors took profits from the post-election rally. On Thursday, the pressure on equities was due to the strengthening of the dollar, which reached the upper boundary of a two-year range against a basket of major currencies. On Friday, however, index futures fell in line with the weakening DXY.

At the same time, markets remain generally confident about the future, with the VIX Fear Index below 15 and close to four-month lows. The Fear and Greed Index at 59 is on the cusp of exiting ‘greed’. The recent peak earlier this week was below the ‘extreme greed’ levels associated with overbought conditions, leaving the potential for a cautious comeback by buyers after some localised profit-taking. It is also worth remembering that the period from November to January is one of the best seasons for equities, especially during bull markets.

A pullback in the S&P500 to the 5900 area could be an important correction target. This is also a round level, a pullback area to 61.8% of the upside momentum from early November and just above the October highs. A deeper target could be the 5670-5700 area, which nullified the last impulse but represents a retracement to 61.8% and the July and August highs of the medium-term advance from the August lows.

The FxPro Analyst Team