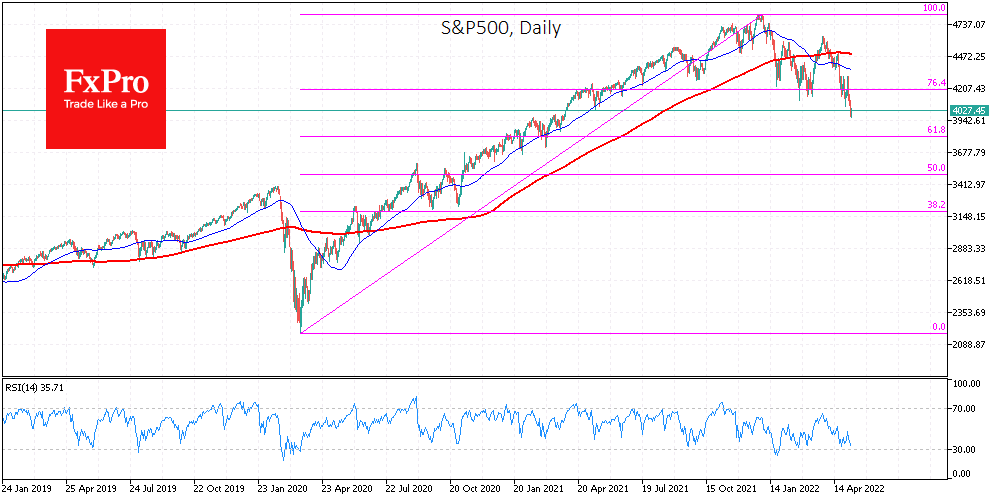

The S&P500 index lost about 3.2% Monday, closing below 4,000, a significant round level. The performance of S&P futures on Tuesday morning is feeding us with cautious optimism, pointing to buyers’ dominance at the start of trading in Europe. The market looks emotionally and technically oversold, which allows you to expect a rebound in the coming days.

The current values for the US S&P500 are the lowest in 13 months. At the beginning of last year, the index did not take the high of 4000 at the first attempt, and now this level could be no less significant support.

The local disposition shows that the market looks oversold after almost a month and a half of decline. Meanwhile, the Relative Strength Index hints at potential exhaustion of the downside momentum, as along with new lows in the S&P500, the RSI on the daily charts has not updated its lows.

Moreover, since January, a sequence of lower local lows for S&P has been followed by higher lows for RSI. A reversal often follows this, and the crucial round level 4000 could be just that.

The Nasdaq100 has taken an even more pronounced loss in the last six months, losing more than 27% from the peak to the bottom, and yesterday it touched lows from December 2020. However, we also see an accumulated oversold condition, which could work as at least a temporary shock absorber for a bounce.

The Nasdaq100 has corrected to more than 61.8% from a rise from the lows of December 2018 to the highs of November 2021 and is around the August-November 2020 peaks, which puts it in line with the S&P500. Although it wanders into the bear market territory, it could still receive support from buyers in the coming days.

Among the fundamental reasons to buy are expectations of an imminent peak in inflation, which is often a turning point for the stock market, and expectations that the economy will continue to pick up, which will restore confidence in companies to rebuild their earnings. This makes the stock market potentially attractive for buying from current levels.

The FxPro Analyst Team