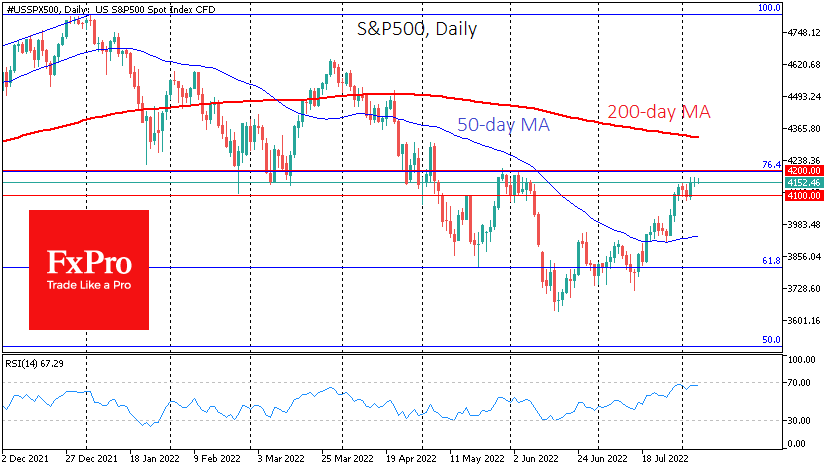

The S&P500 is at 4150, having returned to the rebound highs of late May. The direction of the breakout outside the 4100-4200 range will determine its future for the next days or weeks.

In mid-June, the S&P500 halted its correction from the all-time highs. After losing around 25% in just over six months and returning to the lows since December 2020, the stocks have turned up, despite the background rather than thanks to it. In the last month and a half, the financial world has seen two 75-point Fed rate hikes, a shocking downturn in the housing market and a cooling of consumer demand. That said, the index has continued to crawl upwards, even if this recovery cannot be called flat.

Technically, the S&P500 made a classic Fibonacci correction of the rally from March 2020 to all-time highs in early 2022, getting support on the 61.8% retracement area.

Late last month, a significant signal to break the downtrend was the consolidation above the 50-day moving average, which later turned from resistance into support.

However, locally, it is too early for the bulls to celebrate the return of the bull market. The RSI index on the daily charts is approaching the overbought area, raising the question of a legitimate pullback after a month and a half rally. Separately, the S&P500 index is approaching the circular 4200 level, almost coinciding with the 76.4% retracement of the global rally.

The above disposition shows that gravitational pressure is building up in the equity market, and the downside momentum risks are rising markedly in the near term.

From a longer-term perspective, however, a consolidation above the 4200 levels would mark the start of a new, more solid phase of the equity market recovery. The further upside would no longer be called a “bear market rally”. It would be more of a “return to the upside after a six-month correction”.

And if the immediate correction takes the S&P500 under 4100 – below the previous local lows – it would indicate that the bearish momentum is taking hold, and we might see a new decline. In that case, investors should be prepared that the markets will not only return to the lows of June but also rewrite them, taking the index towards 3000.

The FxPro AnalystTeam