Stocks rose on Tuesday, recovering some of the steep losses from the previous session, as Amazon led shares of Big Tech higher. The S&P 500 traded 0.7% higher. The Nasdaq Composite climbed 1.2%. The Dow Jones Industrial Average advanced 82 points, or 0.3%.

Amazon shares rose 4.9% after a Bernstein analyst upgraded the e-commerce giant to buy from hold, noting the recent pullback offers an attractive “entry point” for investors. Facebook, Alphabet and Microsoft were also up more than 1%. Netflix rose by 0.3%. Traders also digested remarks by Federal Reserve Chairman Jerome Powell, who reiterated the central bank will support the economy “for as long as it takes.” Powell added that, while the path forward “continues to be highly uncertain,” economic activity has “picked up.”

Tuesday’s gains put the S&P 500 and Nasdaq on track to snap four-day losing streaks, the their longest slides since February. The Dow was headed for its first daily gain in four. To be sure, sentiment was kept in check after U.K. Prime Minister Boris Johnson announced further restrictions to curb the spread of the virus. He noted the country was at a “perilous turning point” and ordered bars and restaurants to close between 10 p.m. and 5 a.m. The restrictions also expand the list of places requiring people wear a mask.

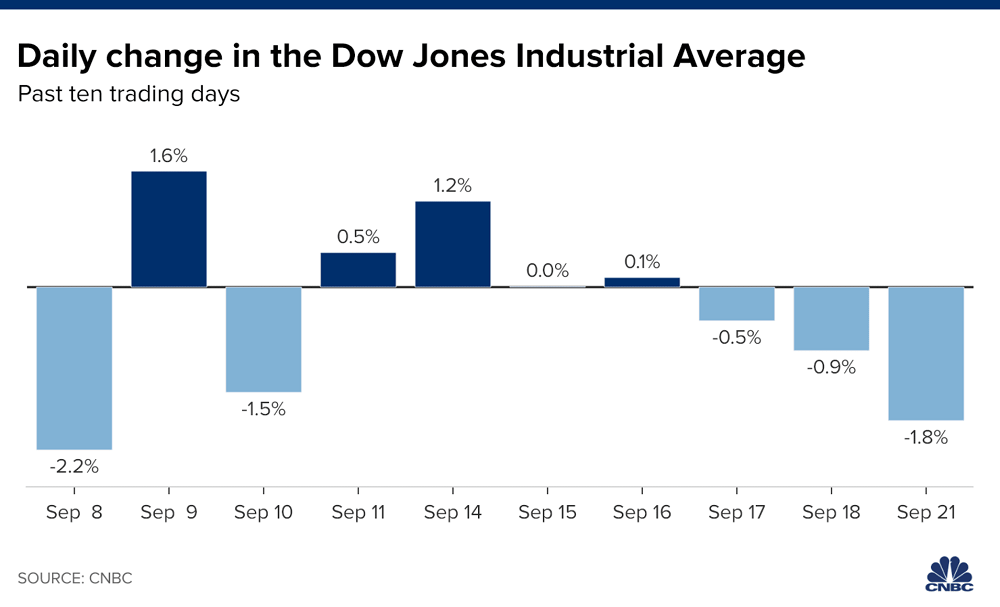

Wall Street was coming off a steep sell-off in the previous session, with the Dow posting its biggest one-day loss since Sept. 8 on Monday. Those losses were driven in part by the prospects of further U.S. coronavirus fiscal stimulus becoming bleaker as lawmakers brace for a potentially bitter Supreme Court confirmation fight as President Donald Trump rushes to nominate a successor to Justice Ruth Bader Ginsburg, who died on Friday.

September has been a tough month on Wall Street. The S&P 500 is down more than 5% month to date and the Nasdaq has plunged 7.4% in that time. The Dow has lost 4.2% in September.

Shares of Tesla dropped 4% after CEO Elon Musk said in a tweet that the electric carmaker’s “Battery Day” event would not reach “serious high-volume production” until 2022, which disappointed investors and analysts.

S&P 500 rises for the first time in five days, Amazon up 4%, CNBC, Sep 22