Stock futures rose on Tuesday after better-than-expected earnings from two retail giants, putting the S&P 500 on track to exceed its previous record close set in February before the coronavirus hit.

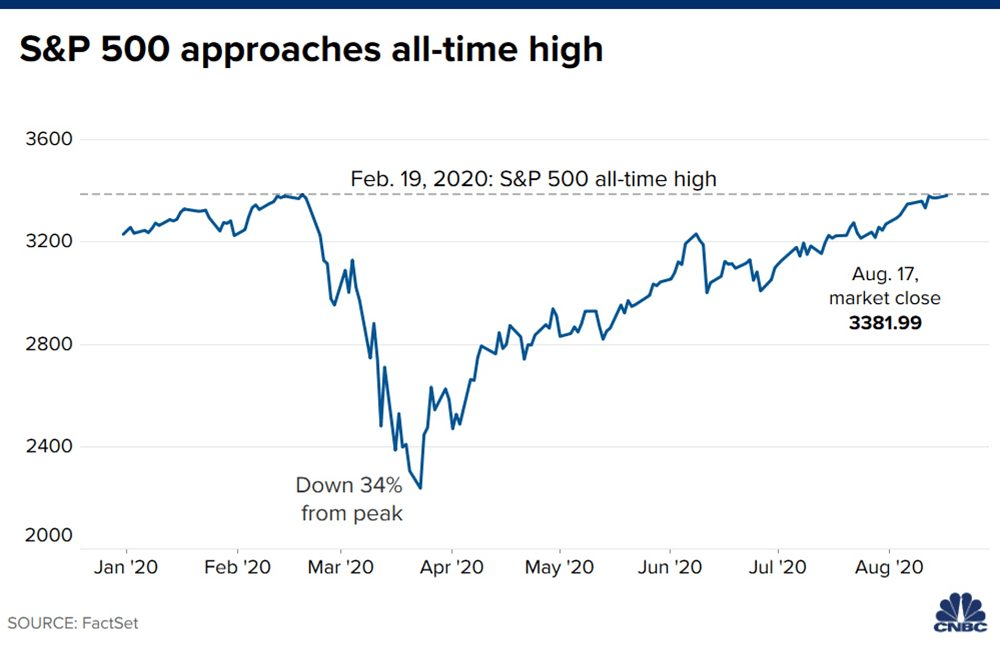

The S&P 500 closed Monday at 3,381.99, just a few points from its record close of 3386.15 set on Feb. 19 and 0.3% below its intraday record of 3393.52.

S&P 500 futures added 8.2 points, or 0.25%. Futures on the Dow Jones Industrial Average gained 0.4%. The move implied an opening gain of about 122 points. Nasdaq-100 futures added 0.4%.

The broad equity gauge has been flirting with a new all-time high since last week.

The S&P 500 has rallied more than 50% from its March bottom amid massive fiscal stimulus and better-than-feared earnings results. The tech-heavy Nasdaq Composite hit a new record close and intraday high during Monday’s trading, pushing its 2020 gains to 24%.

The market has been stuck in a tight range as hopes for a new coronavirus stimulus deal dimmed with lawmakers unwilling to break a stalemate. Democrats and Republicans are holding their respective presidential nominating conventions this week and next.

Meanwhile, tensions between the U.S. and China still kept investors on edge. The Trump administration announced on Monday it will further tighten restrictions on Huawei, aimed at cracking down on the Chinese telecom giant access to commercially available chips.

Stock futures rise amid strong Walmart and Home Depot earnings, S&P 500 on track for record close, CNBC, Aug 18