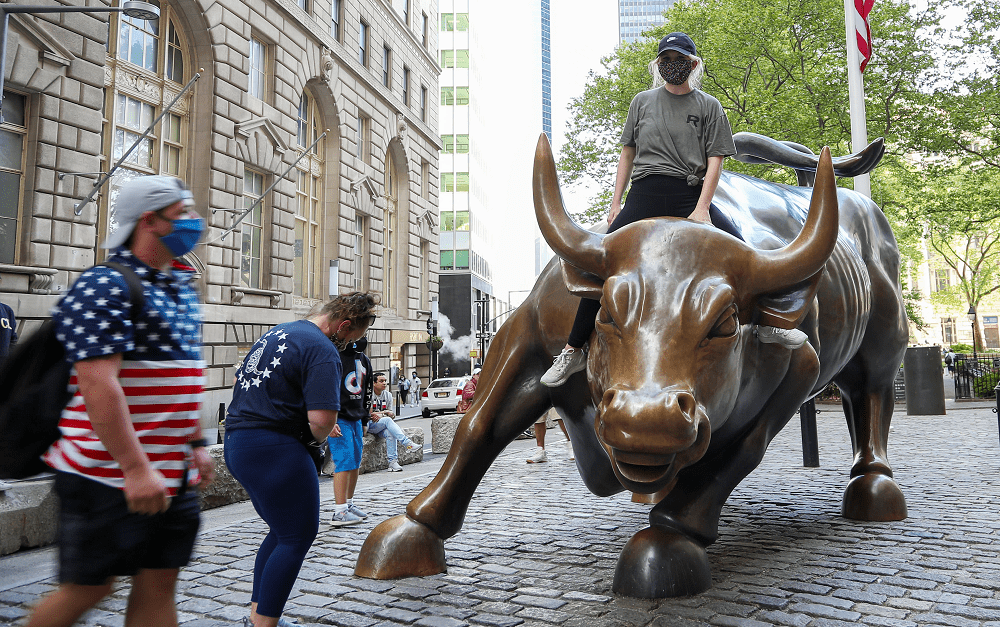

The S&P 500 rose to another record high on Thursday amid a strong rally in major technology stocks. The broad equity benchmark gained 0.3% to hit an all-time high after closing at a record in the previous session. The tech-heavy Nasdaq Composite rallied 0.9% as the FAANG shares of Facebook, Amazon, Apple, Netflix and Google-parent Alphabet were all about 1% higher. The Dow Jones Industrial Average was flat. Investors processed a worse-than-expected reading on the latest weekly jobless claims. A total of 744,000 Americans filed for unemployment benefits for the first time during the week ended April 3, the Labor Department said Thursday. Economists polled by Dow Jones expected first-time claims to total 694,000.

Federal Reverse chairman Jerome Powell signaled on Thursday that the economic rebound from the pandemic still has room to go as the recovery thus far hasn’t been well-rounded. Powell also repeated that inflation is not expected to be serious even though near-term price pressures are likely. President Joe Biden spoke on Wednesday from Washington about his administration’s $2 trillion infrastructure plan that includes a corporate tax rate hike to 28% and noted that he is willing to negotiate on the proposed tax increase. The proposed increase to the corporate tax is thought to be a key source of tax revenue for the White House infrastructure plan and is a non-starter for Republicans, who say they are concerned about tax increases as the U.S. economy emerges from the Covid-19 pandemic.

Fiscal support is considered a key driver of the past month’s equity records and strong economic data, including a stronger-than-expected March jobs report. The S&P 500, Dow industrials and Nasdaq Composite are all coming off their fourth straight quarter of gains as the economic recovery from Covid-19 accelerates.

S&P 500 hits another all-time high as Big Tech stocks rally, CNBC, Apr 9