The S&P 500 closed at a record high on Tuesday, rebounding from huge losses triggered by the coronavirus pandemic and crowning one of the most dramatic recoveries in the index’s history. Trillions of dollars in fiscal and monetary stimulus have made Wall Street flush with cash, pushing yield-seeking investors into equities. Amazon and other high growth technology-related stocks have been viewed as the most reliable to ride out the crisis.

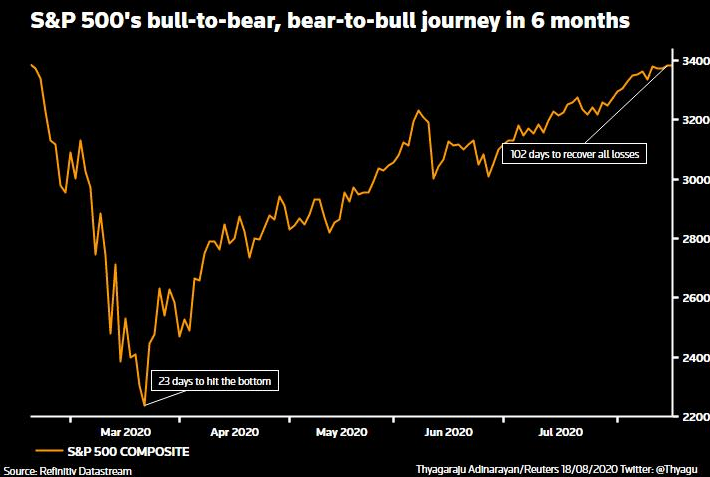

The S&P record confirms, according to a widely accepted definition, that Wall Street’s most closely followed index entered a bull market after hitting its pandemic low on March 23. It has surged about 55% since then. That makes the bear market that started in late February the S&P 500’s shortest in its history.

Since the March 23 closing low, the S&P posted the largest gain in a 103-day period in 87 years, according to Refinitiv data. The Dow Jones Industrial Average fell 66.84 points, or 0.24%, to 27,778.07, the S&P 500 gained 7.79 points, or 0.23%, to 3,389.78 and the Nasdaq Composite added 81.12 points, or 0.73%, to 11,210.84.

Meanwhile Nasdaq clocked its 18th record closing high since early June, when it confirmed its recovery from the coronavirus sell-off. Tuesday’s record was its 34th record close so far this year compared with 31 record closing highs in 2019 and 29 in 2018.

Minutes from the Federal Reserve’s recent meeting due on Wednesday may provide some insight into how the central bank sees the recovery playing out. The Fed has cut rates to near zero to bolster business through the pandemic.

The S&P 500 posted 31 new 52-week highs and no new lows; the Nasdaq Composite recorded 70 new highs and 18 new lows.

The pandemic bull market: S&P 500 closes at record high, Reuters, Aug 19