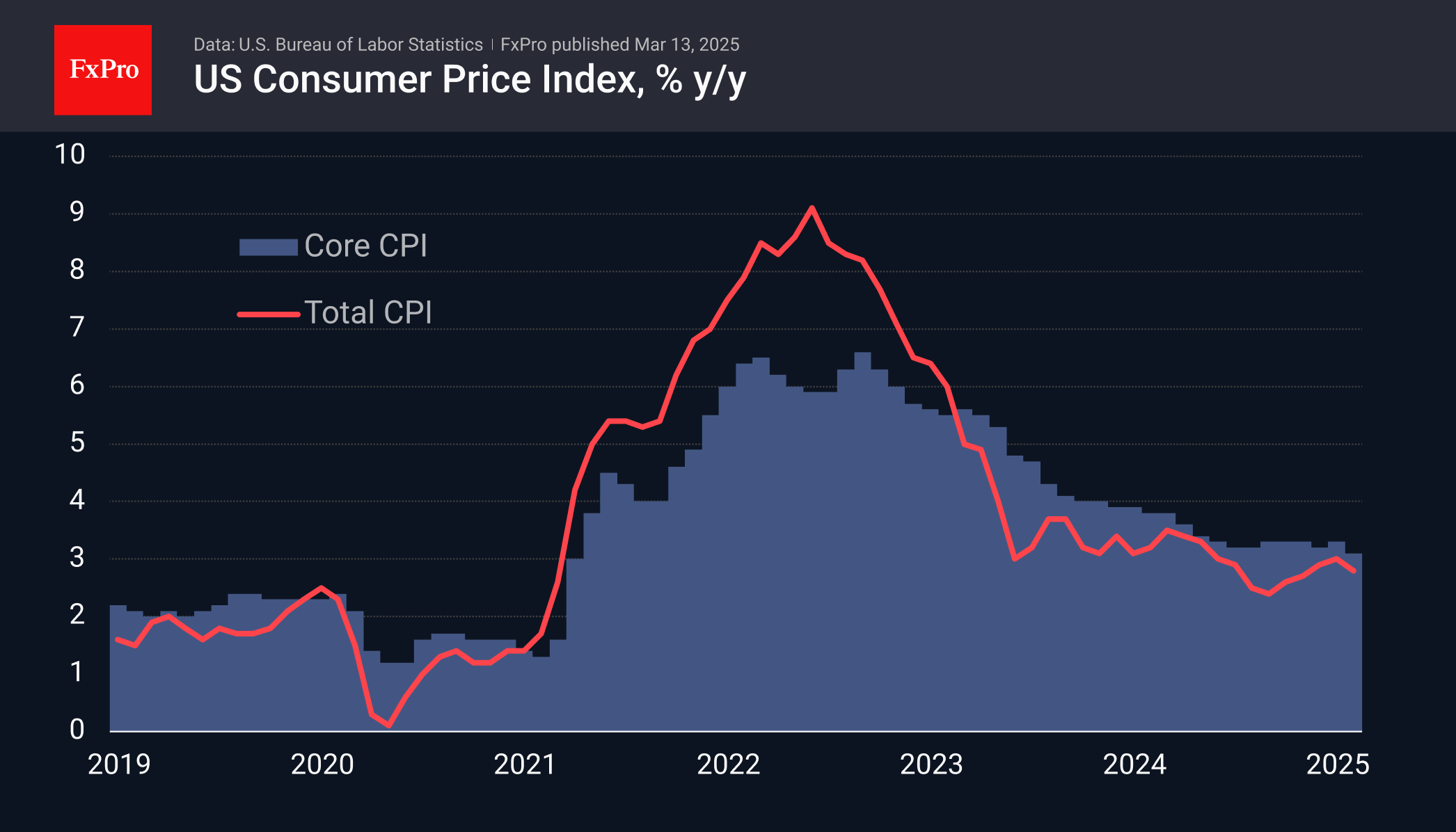

US consumer inflation slowed from 3.0% to 2.8% for the headline index and from 3.3% to 3.1% for the core index.

US CPI went weaker than expected, continuing the slowdown. If we divide the reasons for the Fed’s rate cuts into ‘good’ and ‘bad’ in terms of their impact on investor sentiment, the growing threat of recession is bad, and slowing inflation is good. Together, they reinforce the dovish position at the central bank and bring a rate cut closer.

Bad reasons have been driving the markets in recent weeks. A downward turn in inflation is more likely to be good news for equities. Markets have so far tended to put all the facts in one basket, looking for growing signs of recession as a reason to sell stocks.

However, we are noting gold’s rebound to all-time highs, silver’s strengthening to 4-month highs and oil’s reversal to the upside. In addition, Wall Street ended the day with gains in the S&P500 and Nasdaq100 indices, although the rebound is hardly impressive.

The next big event for the markets is the Fed meeting on 19th March, and all eyes will be on the signals regarding when the next rate cut will be. In recent weeks, markets have moved the date of the next cut from the end of the year to June. The market will likely maintain its weakness into the middle of next week in order to sell the Fed on a softer tone.

The FxPro Analyst Team