Chinese stock indices led the gains on Monday following reports that the government will adopt a ‘moderately loose’ monetary policy, as opposed to the ‘prudent’ one previously in place. This change in tone saw the Hang Seng Index rise by almost 6%. Admittedly, it only helped bring it back to where it was a month ago.

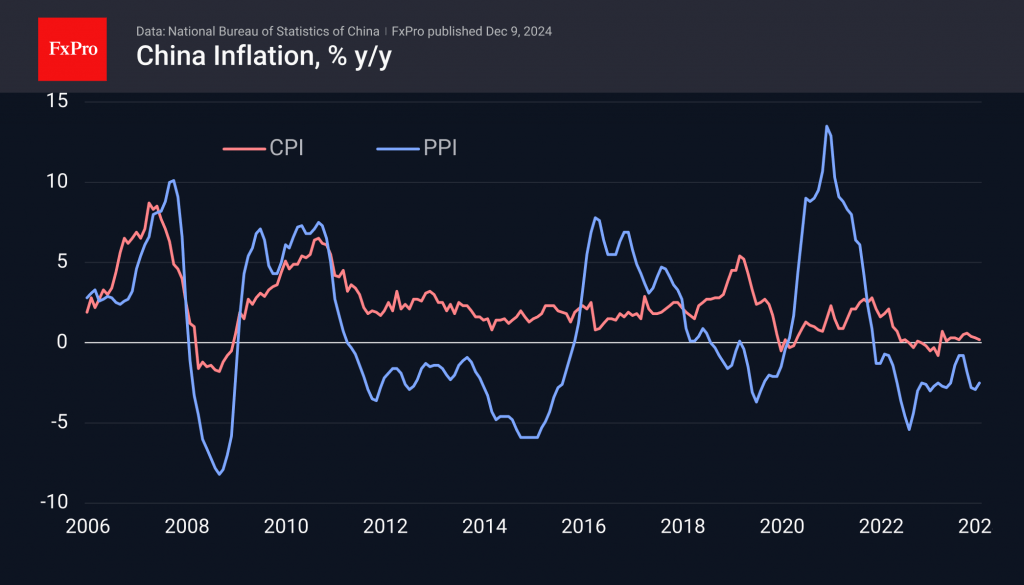

The latest change was likely a reaction to fresh inflation data released on Monday morning. According to the latest data, China’s consumer inflation slowed to 0.2% y/y after decelerating since August, contrary to expectations of an acceleration of 0.4%.

However, the producer price index beat expectations. Its decline slowed to 2.5% y/y from 2.9% the previous month, and 2.5% was expected. This index had come close to positive territory in June and July but turned down again. The stimulus has been too cautious and limited.

An important consequence of the shift to looser monetary policy is pressure on the local currency. Nevertheless, the USDCNH returned below 7.29 during the day on Monday. Since the beginning of last week, the pair has been under pressure near the upper end of the range since November 2023, near 7.30. Inflation figures, monetary policy and fears of tariff wars are setting the stage for pressure on the Chinese currency. The ability to create resistance so far seems to indicate the authorities’ intention to stabilise the exchange rate, which is unlikely to deter market speculators for long.

The FxPro Analyst Team