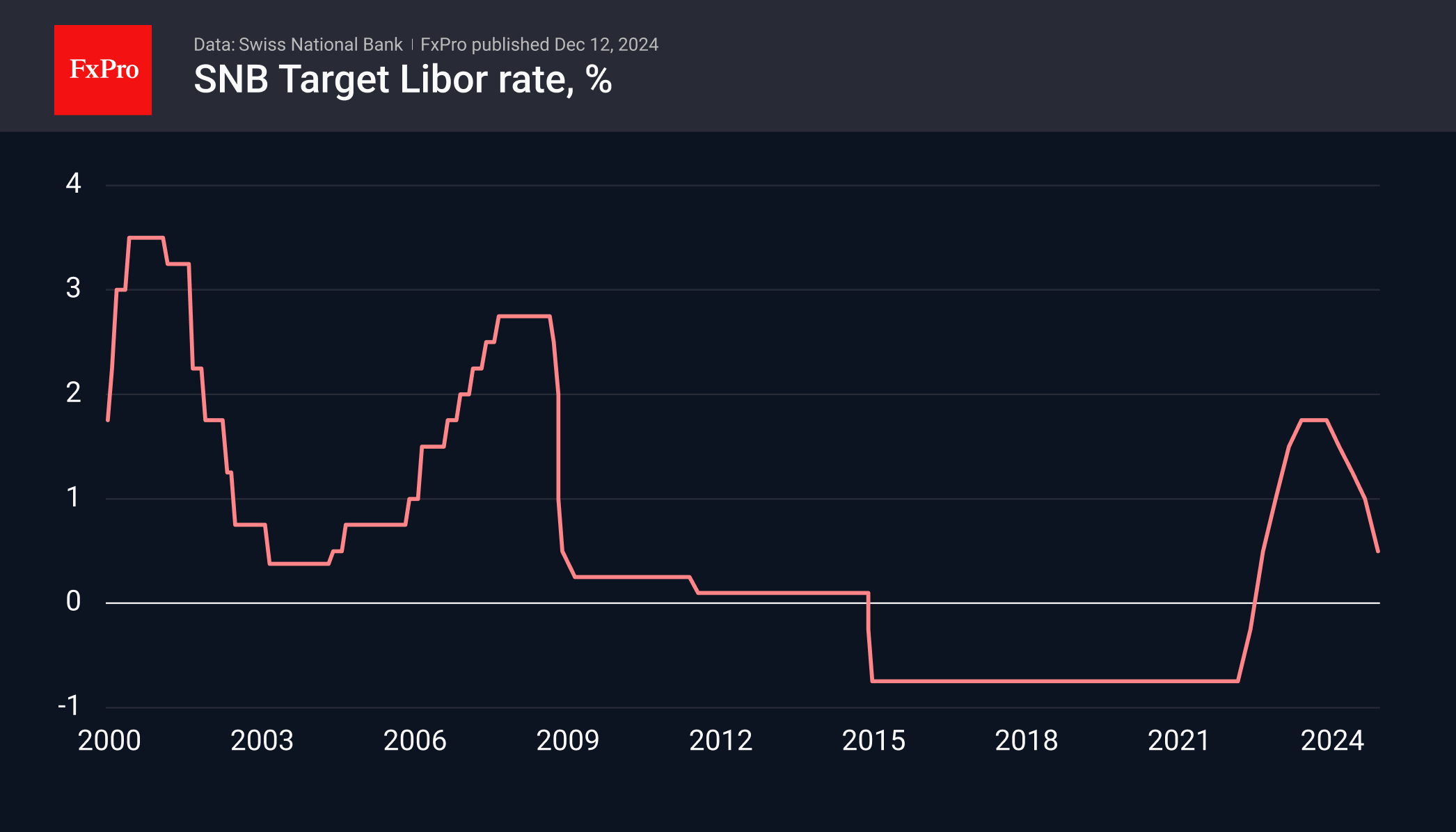

The Swiss National Bank cut its key interest rate by 50 points to 0.5%, a bigger move than markets had expected. The SNB has now cut the rate by 125 points in four meetings since March. That’s not a record in the G10, where the Bank of Canada has cut by 175 points, and the ECB is expected to cut by 135 points. In Switzerland, however, subdued inflation brought rates back close to zero.

The consumer price index slowed to 0.6% y/y, the lowest since 2021. Prices have been either flat or falling for the past six months. The Producer and Import Price Index has been falling for a year and a half, with the latest reading at -1.8% y/y.

The USDCHF gained 0.8% on the back of a deeper than expected rate cut. It has gained more than 5% since the end of September, driven by the global strength of the US dollar. The strength of the franc is evident in the crosses: CADCHF has been repeatedly supported by dips below 0.6200, an all-time low, while EURCHF is only 50 pips above sustained historical lows.

The SNB seems to want to reverse the trend of franc appreciation but is being too cautious in the face of a similarly sized easing. The SNB has indicated a reluctance to return to a negative interest rate policy, making currency intervention the next important option.

Active traders may want to watch the EURCHF if it falls below 0.9250, as further rate hikes are possible. A reversal of the multi-year trend can only be discussed if the pair consolidates above 0.9450-0.9500.

The FxPro Analyst Team