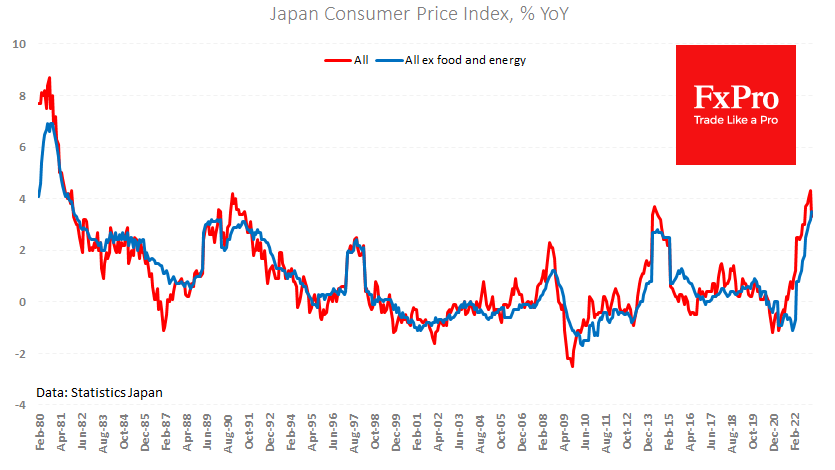

Japan’s headline inflation rate slowed from 4.3% to 3.3% in February. The point is that prices fell by 0.6% for the month, so the slowing annual inflation cannot simply be attributed to a high base effect.

The core index (excluding energy and food) was up 0.3% for the month, and annual growth accelerated from 3.2% to 3.5% in February, the highest rate since 1982.

The continued acceleration in core inflation pressures the BoJ to tighten its monetary policy. However, it cannot be ruled out that Japan might avoid tightening its monetary policy altogether. Other major central banks’ interest rate hikes have put pressure on commodity prices and limited economic growth.

Now, after a respite of a few months, the recession in the major developed economies is more clearly on the agenda, as the Fed was more open about it at its last meeting.

The banking problems in the US and Europe are an additional drag on the economy and hence on prices. Another side effect has been the rapid appreciation of the Yen against the backdrop of the banking problems. From a high of 137.5, the USDJPY fell below 130 early on Friday. Interest in this currency has been sparked by falling US and Europe long-term bond yields and is also being boosted by deleveraging in the financial markets.

However, it is essential to understand that the problems in the financial world are a short-term support factor for the Japanese currency. If the ECB and the Fed tighten, the BoJ is unlikely to stand aside. From this point of view, it is hard to argue that the Yen is on a steady growth path.

The FxPro Analyst Team