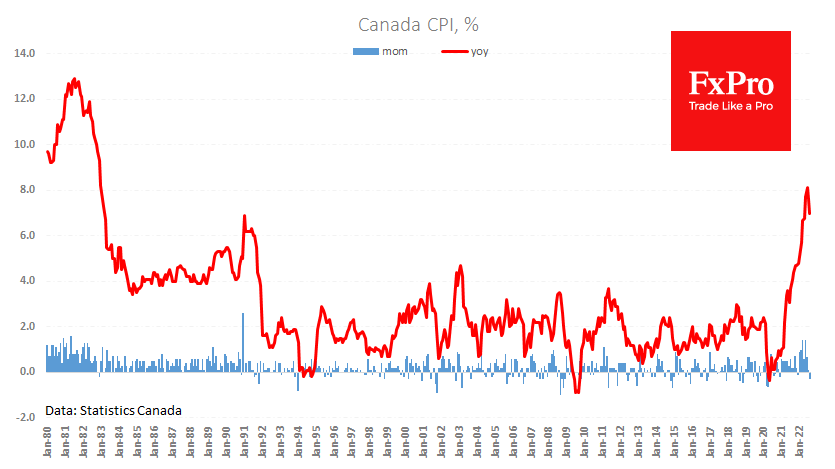

Canadian consumer prices fell 0.3% in August, the first decline this year and the strongest since May 2020. The annual rate of price growth fell from 7.6% to 7.0%.

The USDCAD pair turned sharply higher a week ago after briefly touching the 50-day moving average and returning to below 1.30. Since then, the pair has added around 2.5%, yesterday climbing to the highs from October 2020 above 1.3340.

USDCAD has been moving upward since last June, enjoying periodic corrections as opposed to the much more one-sided weakening of the euro, yen, and pound against the dollar. The USDCAD is now trading near the upper boundary of this corridor, where we should expect a showy battle between bulls and bears.

A consolidation above 1.3350 might be the first step towards acceleration in the pair, and a rapid slowdown in inflation plays in favour of this scenario.

However, traders and investors should be prepared for another local reversal, as has been the case many times over the past 15 months.

The FxPro Analyst Team