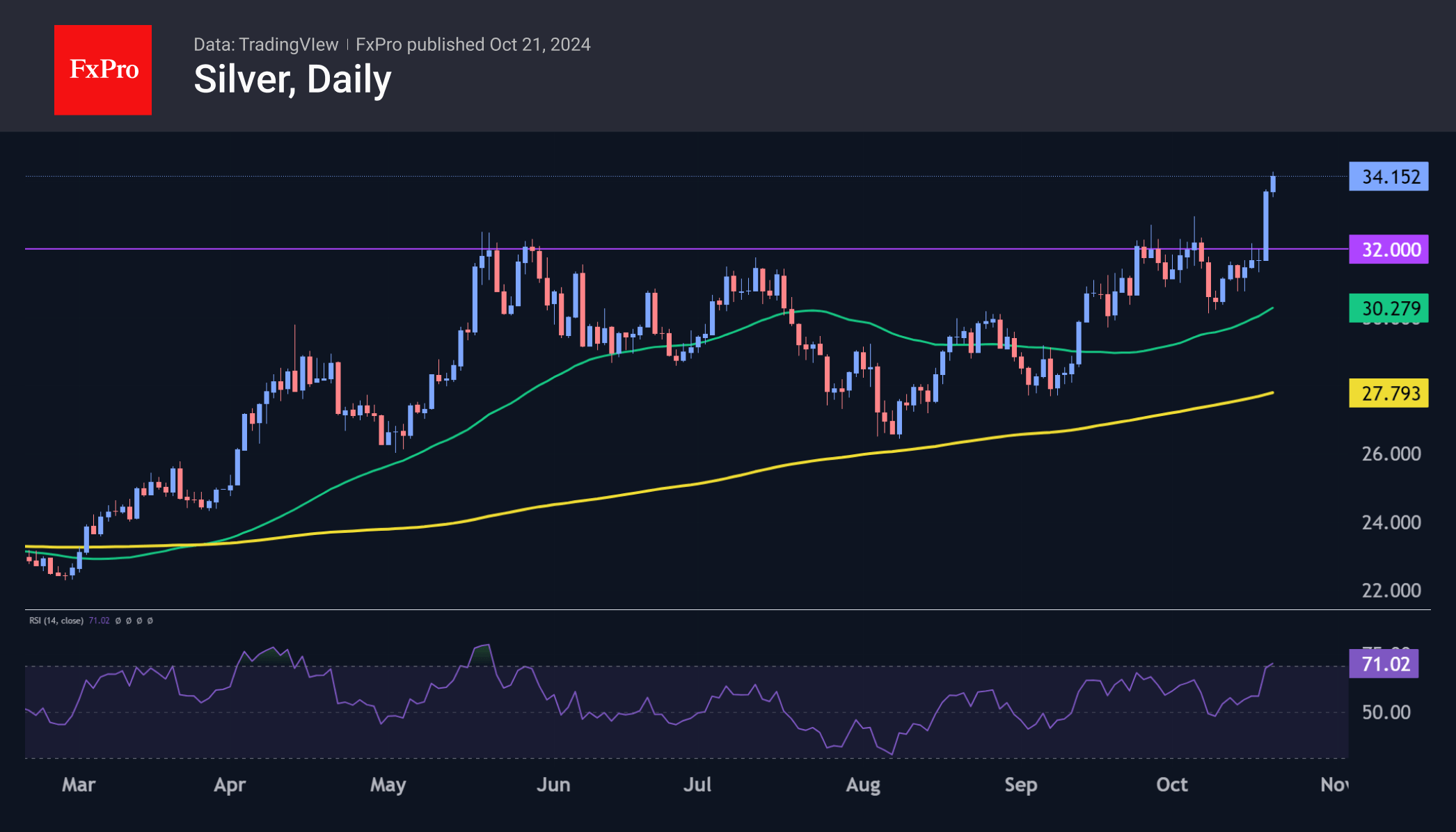

Silver revived last week and made a decisive move on Friday to renew multi-year highs. At the start of the new week, the price was above $34 per troy ounce, a level last seen in November 2012.

Since May this year, prices have pulled back several times, but silver broke through resistance at $32 and rose more than 7% on Friday, adding to Monday’s 1.3% gain.

The Relative Strength Index (RSI) has surged above 70 on the daily chart, indicating that silver may be approaching ‘overheated’ territory, particularly as RSI readings near 80. However, this range is also often accompanied by accelerating gains.

The next potential upside target for silver looks to be the $35 area, where the 2012 rally ended after the 2011 sell-off. However, a potential shakeout of short- and medium-term bullish positions in the $32–$35 range could pave the way for long-term buyers to step in decisively. This shift may set the stage for silver to target a new all-time high, potentially surpassing the $50 mark reached in April 2011.

The FxPro Analyst Team